For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.1913, following robust economic data in the Euro-zone.

Data indicated that the Euro-zone’s preliminary consumer price index (CPI) climbed more-than-expected by 1.5% on an annual basis in August, hitting its highest since April 2017, suggesting that price pressures in the common currency region are regaining some momentum. In the prior month, the CPI had gained 1.3%, while markets were expecting it to rise by 1.4%. Additionally, the region’s unemployment rate remained unchanged at an eight-year low level of 9.1% in July, meeting market consensus.

Separately, Germany’s seasonally adjusted unemployment rate remained steady at a record low level of 5.7% in August, in line with market expectations. On the contrary, the nation’s retail sales fell more-than-anticipated by 1.2% on a monthly basis in July, stoking fears that private consumption in the Euro-bloc’s biggest economy may have lost momentum at the start of the third quarter.

The greenback lost ground against a basket of currencies, after pending home sales in the US unexpectedly dropped 0.8% on a monthly basis in July, confounding market anticipations for a rise of 0.3% and following a revised gain of 1.3% in the previous month. Meanwhile, the nation’s initial jobless claims rose to a level of 236.0K in the week ended 26 August 2017, lower than market expectations for a rise to a level of 238.0K. In the previous week, initial jobless claims had recorded a revised level of 235.0K.

Another data indicated that personal spending in the US climbed 0.3% MoM in July, undershooting market expectations for a rise of 0.4%. In the prior month, personal spending had risen by a revised 0.2%. Further, the nation’s personal income recorded a more-than-expected rise of 0.4% on a monthly basis in July, while markets anticipated for an advance of 0.3%. In the prior month, personal income had registered a flat reading. Also, the nation’s Chicago Fed purchasing managers index remained steady at a level of 58.9 in August, while investors had envisaged the index to ease to a level of 58.5.

In the Asian session, at GMT0300, the pair is trading at 1.1905, with the EUR trading 0.07% lower against the USD from yesterday’s close.

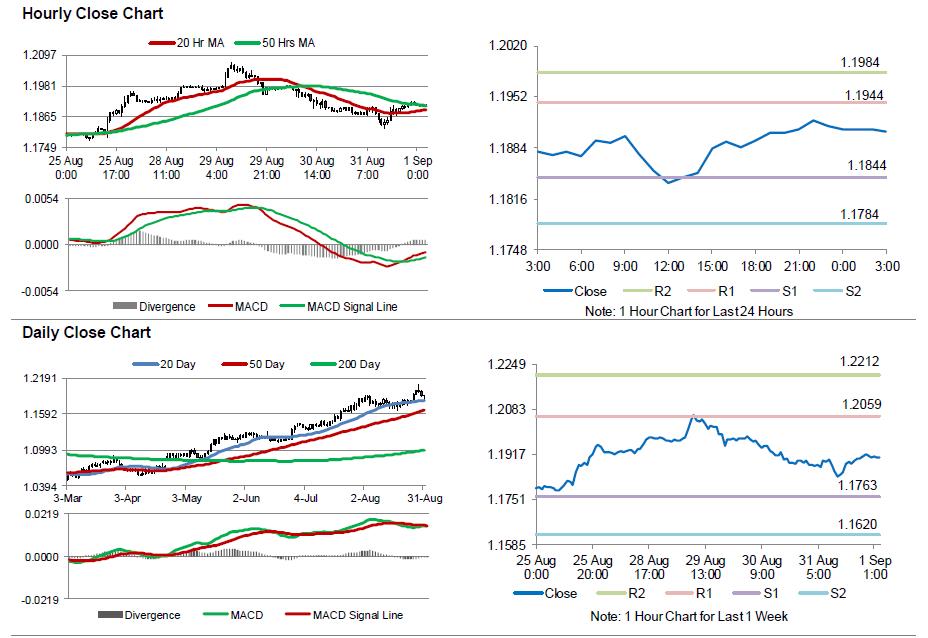

The pair is expected to find support at 1.1844, and a fall through could take it to the next support level of 1.1784. The pair is expected to find its first resistance at 1.1944, and a rise through could take it to the next resistance level of 1.1984.

Moving ahead, investors will keep a close watch on the final Markit manufacturing PMI for August across the Euro-zone, slated to release in a few hours. Moreover, traders anxiously awaited the US non-farm payrolls, unemployment rate and average hourly earnings data, all for August, scheduled to release later in the day. Moreover, the nation’s construction spending for July, ISM manufacturing PMI as well as final Michigan consumer confidence index, both for August, will also be eyed by traders.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.