For the 24 hours to 23:00 GMT, the GBP rose 0.15% against the USD and closed at 1.2941, following hawkish remarks from the Bank of England’s (BoE) monetary policy committee member, Michael Saunders.

Michael Saunders urged for an immediate interest rate hike in order to combat rising inflation and warned a delay could lead to ‘a more abrupt and painful economic slowdown’. Further, he added that risks emerging from Britain’s departure from the European Union does not justify holding off raising interest rates at record low levels.

However, gains in the Pound were limited amid heightened concerns over Brexit as the third round of Brexit negotiations concluded with little fruition, while the European Union’s (EU) chief negotiator, Michel Barnier, warned that negotiations were lacking sufficient progress.

In the Asian session, at GMT0300, the pair is trading at 1.2945, with the GBP trading a tad higher against the USD from yesterday’s close.

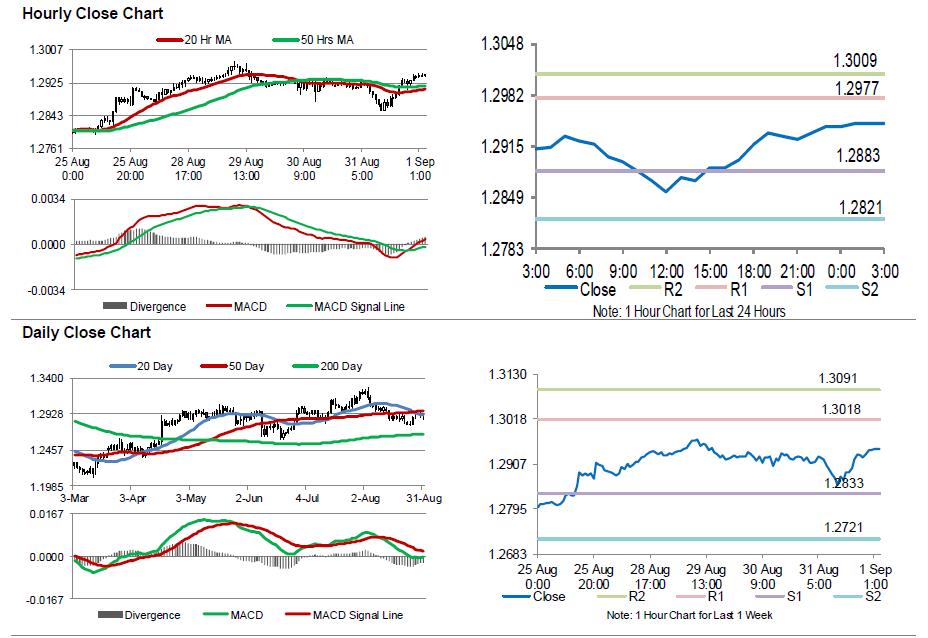

The pair is expected to find support at 1.2883, and a fall through could take it to the next support level of 1.2821. The pair is expected to find its first resistance at 1.2977, and a rise through could take it to the next resistance level of 1.3009.

Ahead in the day, traders will focus on Britain’s Markit manufacturing PMI for August.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.