For the 24 hours to 23:00 GMT, the EUR rose 0.06% against the USD and closed at 1.2380.

On the data front, the Euro-zone’s final consumer price index (CPI) grew less than initially estimated by 1.3% on a yearly basis in March, while the preliminary figures had indicated a rise of 1.4%. The CPI had recorded an increase of 1.1% in the prior month.

In other economic news, the region’s seasonally adjusted construction output slid 0.5% on a monthly basis in February, following a revised drop of 0.8% in the prior month.

Separately, according to the US Federal Reserve’s (Fed) Beige Book report, economic activity in the US expanded at a ‘modest to moderate’ pace in March and early April. However, businesses expressed concerns over widening global trade disputes and newly introduced trade tariffs. Further, firms reported solid business borrowing, continued robust job growth as well as rising consumer spending in the US economy.

In economic news, the MBA mortgage applications in the US rebounded 4.9% in the week ended 13 April 2018, compared to a fall of 1.9% in the prior week.

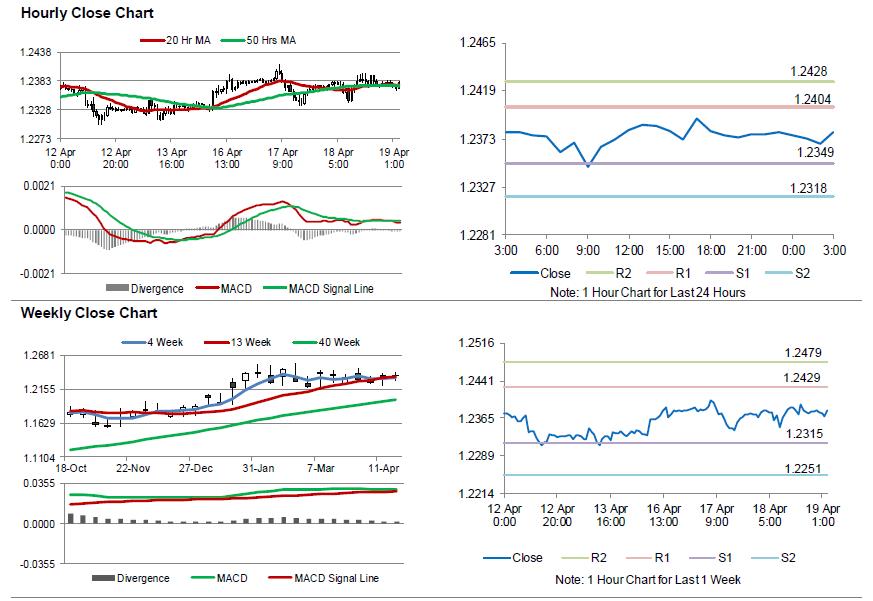

In the Asian session, at GMT0300, the pair is trading at 1.2380, with the EUR trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.2349, and a fall through could take it to the next support level of 1.2318. The pair is expected to find its first resistance at 1.2404, and a rise through could take it to the next resistance level of 1.2428.

Moving ahead, investors would focus on the Euro-zone’s current account data for February, slated to release in a few hours. Additionally, the US initial jobless claims as well as Philadelphia Fed business outlook index for April, scheduled to release later today, will be eyed by market participants.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.