For the 24 hours to 23:00 GMT, the GBP declined 0.61% against the USD and closed at 1.4207, after the latest data indicated that British annual inflation growth eased to a one-year low level in March.

Data indicated that Britain’s consumer price index (CPI) advanced 2.5% on an annual basis in March, rising at its weakest pace in a year and casting doubt over the Bank of England’s (BoE) ability to hike interest rate in May. Market participants had envisaged the CPI to rise by 2.7%, after registering a gain of 2.7% in the previous month.

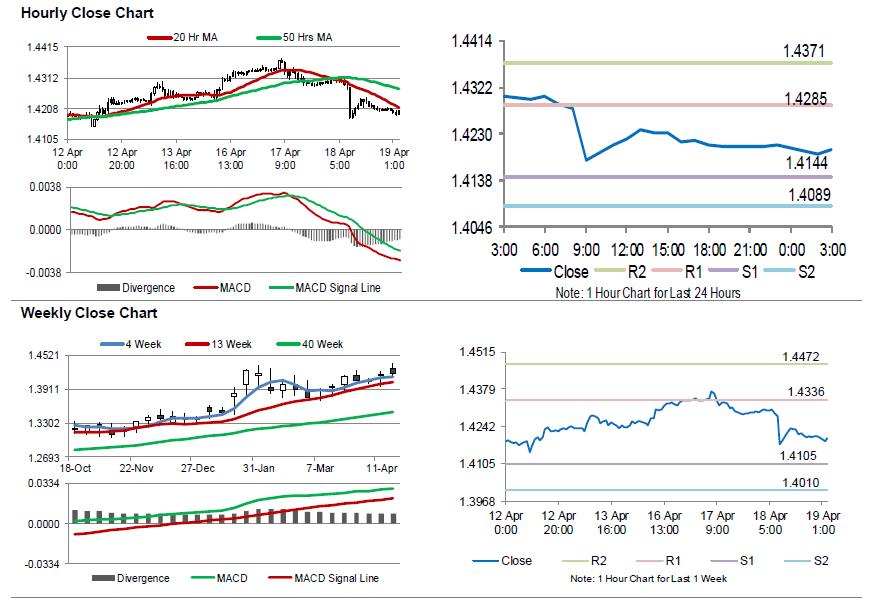

In the Asian session, at GMT0300, the pair is trading at 1.4200, with the GBP trading 0.05% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.4144, and a fall through could take it to the next support level of 1.4089. The pair is expected to find its first resistance at 1.4285, and a rise through could take it to the next resistance level of 1.4371.

Moving ahead, investors would direct their attention to UK’s retail sales data for March, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.