For the 24 hours to 23:00 GMT, the EUR declined 0.73% against the USD and closed at 1.2170, after a couple of officials from the European Central Bank (ECB) voiced worries over the common currency’s sharp rally.

On the macro front, data showed that the Euro-zone’s final consumer price index (CPI) climbed 1.4% on an annual basis in December, confirming the flash estimates and compared to a rise of 1.5% in the prior month. Also, the region’s seasonally adjusted construction output rebounded 0.5% on a monthly basis in November, after recording a revised drop of 0.3% in the prior month.

Macroeconomic data released in the US showed that industrial production climbed 0.9% MoM in in December, beating market expectations for an advance of 0.5%, buoyed by robust gains in utility output. In the prior month, industrial production had recorded a revised fall of 0.1%. Moreover, the nation’s manufacturing production climbed 0.1% on a monthly basis in December, falling short of market consensus for a gain of 0.3%. Manufacturing production had risen by a revised 0.3% in the preceding month.

On the other hand, the nation’s NAHB housing market index eased to a level of 72.0 in January, in line with market expectations. In the prior month, the index had registered a more than 18-year high level of 74.0. Other data revealed that the nation’s MBA mortgage applications rose 4.1% in the week ended 12 January, compared to an increase of 8.3% in the previous week.

Separately, the Federal Reserve’s (Fed) Beige Book report indicated that the US economy and inflation expanded at a modest-to-moderate pace from late November through the end of December 2017, while most districts reported modest increase in wages and tighter labour market conditions. Further, it revealed that the outlook for 2018 remains optimistic for a majority of contacts across the country.

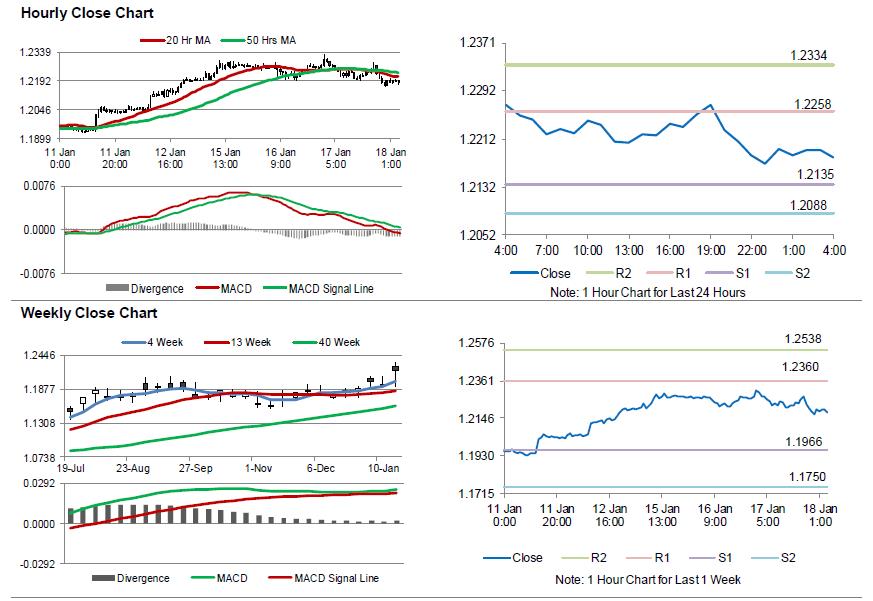

In the Asian session, at GMT0400, the pair is trading at 1.2181, with the EUR trading 0.09% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2135, and a fall through could take it to the next support level of 1.2088. The pair is expected to find its first resistance at 1.2258, and a rise through could take it to the next resistance level of 1.2334.

Amid a lack of macroeconomic releases in the Euro-zone today, investors would look forward to the US housing starts and building permits data for December, followed by initial jobless claims figures, all slated to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.