For the 24 hours to 23:00 GMT, the GBP rose 0.14% against the USD and closed at 1.3809, after an external MPC member of the Bank of England (BoE), Michael Saunders, stated that interest rates will likely have to rise faster-than-anticipated this year as he expects Britain’s labour market to tighten further, pushing wage growth to its fastest rate since the financial crisis.

In the Asian session, at GMT0400, the pair is trading at 1.3807, with the GBP trading slightly lower against the USD from yesterday’s close.

Overnight data indicated that UK’s RICS house price balance registered an unexpected rise to 8.0% in December, compared to a flat reading in the prior month. Markets had anticipated for house price balance to fall to 1.0%.

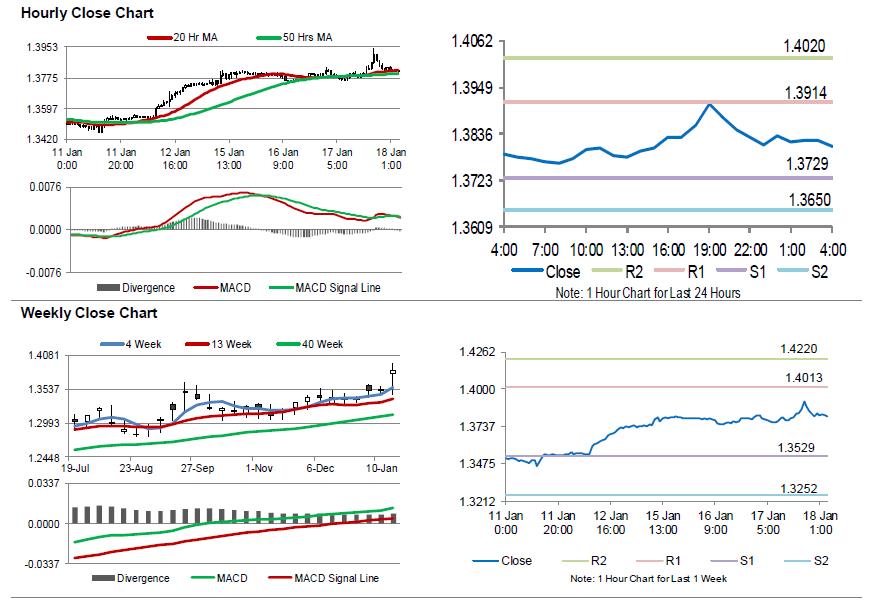

The pair is expected to find support at 1.3729, and a fall through could take it to the next support level of 1.3650. The pair is expected to find its first resistance at 1.3914, and a rise through could take it to the next resistance level of 1.4020.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.