For the 24 hours to 23:00 GMT, the EUR declined 0.77% against the USD and closed at 1.1365 on Friday.

On the macro front, the Euro-zone’s preliminary consumer confidence index declined to a level of -6.2 in December, compared to a reading of -3.9 in the previous month. Market participants had expected for the index to fall to a level of -4.3.

Separately, in Germany, the Gfk consumer confidence index remained unchanged at a level of 10.4 in January, defying market expectations for a drop to a level of 10.3.

The US dollar gained ground against a basket of currencies, amid looming potential US government shutdown.

In the US, data showed that the US final annualised gross domestic product (GDP) climbed 3.4% on a quarterly basis in 3Q 2018, falling short of market anticipations for a rise of 3.5%. In the prior quarter, the annualised GDP had advanced 4.2%, while preliminary figures had recorded an advance of 3.5%. Moreover, the nation’s preliminary durable goods orders rebounded 0.8% on a monthly basis in November, undershooting market expectations for a gain of 1.6%. In the preceding month, durable goods orders had dropped 4.3%. Furthermore, the nation’s personal income jumped 0.2% on a monthly basis in November, less than market expectations for an advance of 0.3%. In the previous month, personal income had recorded an advance of 0.5%. Meanwhile, the final Reuters/Michigan consumer sentiment index unexpectedly advanced to a level of 98.3 in December, compared to market consensus for a decline to a level of 97.4. The preliminary figures had indicated an unchanged reading. In the prior month, the index had registered a level of 97.5. Additionally, the US personal spending rose 0.4% on a monthly in November, compared to a revised rise of 0.8% in the prior month. Market participants had envisaged for personal spending to climb 0.3%.

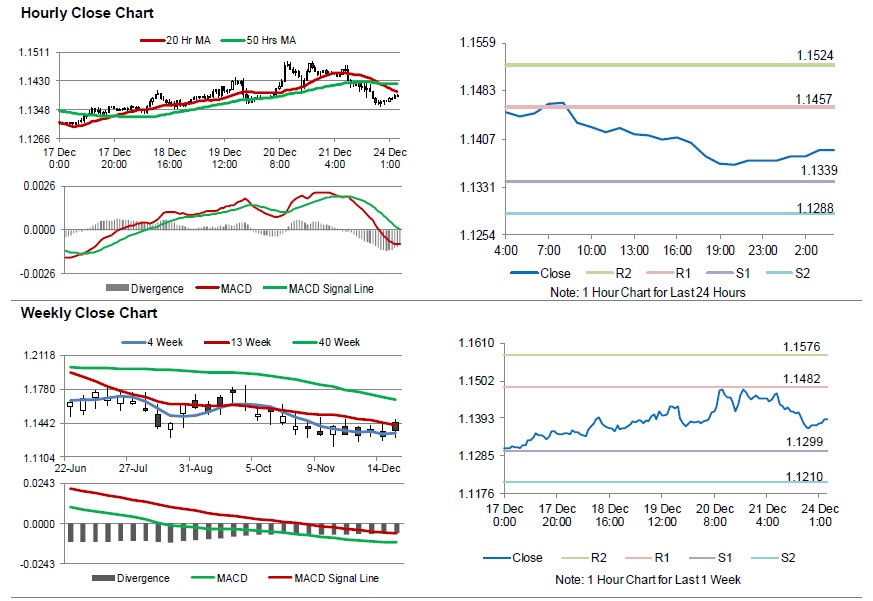

In the Asian session, at GMT0400, the pair is trading at 1.1389, with the EUR trading 0.21% higher against the USD from Friday’s close.

The pair is expected to find support at 1.1339, and a fall through could take it to the next support level of 1.1288. The pair is expected to find its first resistance at 1.1457, and a rise through could take it to the next resistance level of 1.1524.

In absence of crucial macroeconomic releases in the Euro-zone today, traders would keep a close watch on the US Chicago Fed national activity index for November, slated to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.