For the 24 hours to 23:00 GMT, the GBP declined 0.28% against the USD and closed at 1.2630 on Friday.

In economic news, UK’s final gross domestic product (GDP) climbed 0.6% on a quarterly basis in 3Q 2018, at par with expectations and confirming the preliminary print. In the previous quarter, GDP had advanced 0.4%. Additionally, public sector net borrowing deficit widened to £6.4 billion in November, following a revised deficit of £5.6 billion in the prior month. Market participants had envisaged public sector net borrowing to widen to £7.0 billion. On the other hand, current account deficit widened more-than-anticipated to £26.50 billion in 3Q18, compared to a revised current account deficit of £19.95 billion in the prior quarter

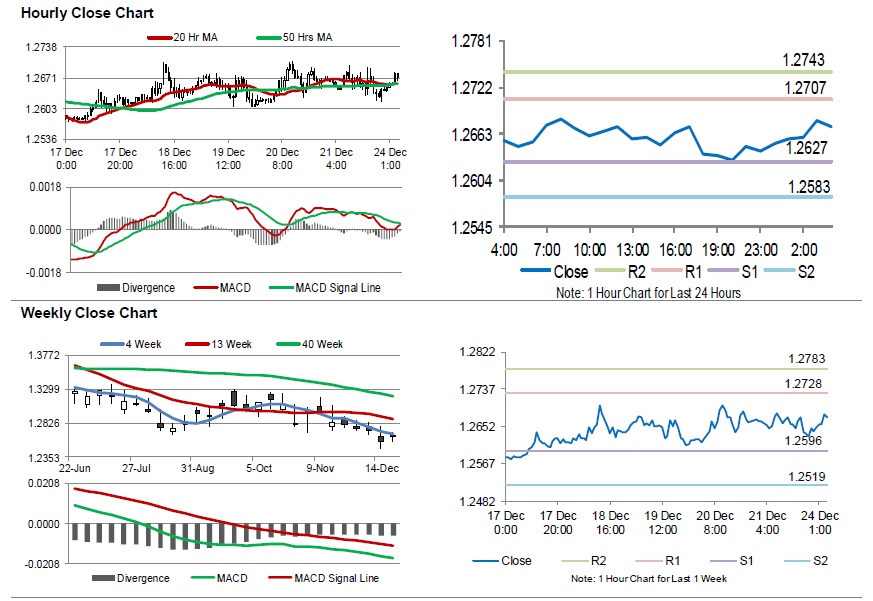

In the Asian session, at GMT0400, the pair is trading at 1.2672, with the GBP trading 0.33% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2627, and a fall through could take it to the next support level of 1.2583. The pair is expected to find its first resistance at 1.2707, and a rise through could take it to the next resistance level of 1.2743.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.