For the 24 hours to 23:00 GMT, the EUR rose 0.41% against the USD and closed at 1.1940, on the back of a surprise improvement in the Euro-zone’s consumer sentiment.

Data indicated that the Euro-zone’s flash consumer confidence index unexpectedly climbed to a level of -1.2 in September, notching its highest level since April 2001 and suggesting that consumers were turning more optimistic in the light of robust economic recovery in the common currency region. Market had expected the index to remain steady at a level of -1.5.

Even though the ECB, in its economic bulletin report, highlighted the healthy growth in the Euro-bloc’s economy, the central bank commented that the robust recovery was unable to translate into stronger inflation, making it necessary to maintain the ultra-loose monetary policy stimulus.

Macroeconomic data released in the US showed that initial jobless claims surprisingly fell to a level of 259.0K in the week ended 16 September, defying market consensus for a rise to a level of 302.0K. In the previous week, initial jobless claims had registered a revised level of 282.0K. Moreover, the nation’s leading indicator advanced 0.4% in August, surpassing market expectations for an advance of 0.3%. In the prior month, leading indicator had recorded a rise of 0.3%. Further, the nation’s Philadelphia Fed manufacturing index unexpectedly rose to a level of 23.8 in September, compared to a level of 18.90 in the prior month. Markets were anticipating the index to drop to a level of 17.1.

In the Asian session, at GMT0300, the pair is trading at 1.1957, with the EUR trading 0.14% higher against the USD from yesterday’s close.

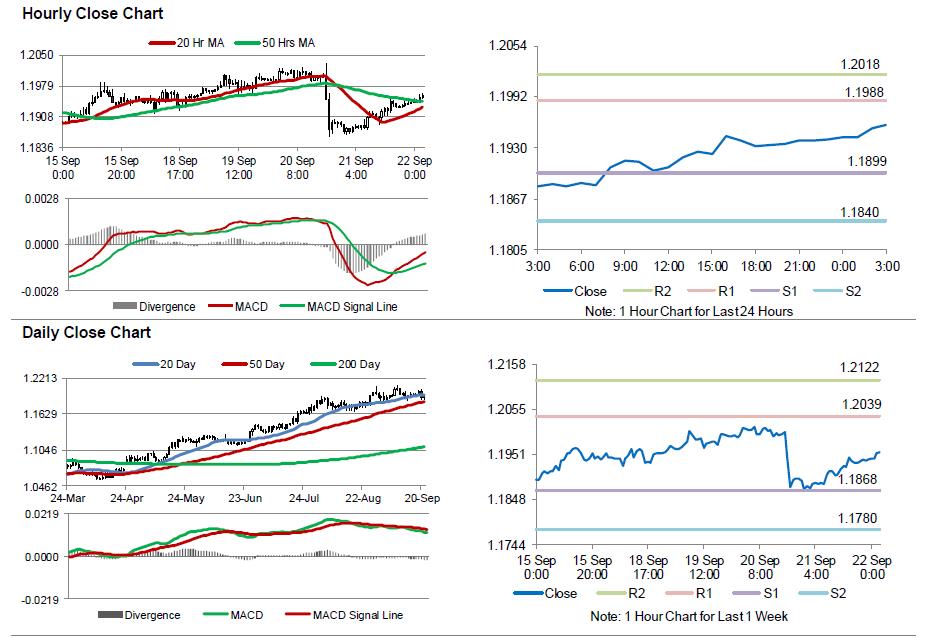

The pair is expected to find support at 1.1899, and a fall through could take it to the next support level of 1.1840. The pair is expected to find its first resistance at 1.1988, and a rise through could take it to the next resistance level of 1.2018.

Going ahead, investors will direct their attention to the flash Markit manufacturing and services PMIs for September across the Euro-zone, slated to release in a few hours. Moreover, the US preliminary manufacturing and services PMIs for September, due to release later today, will also keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.