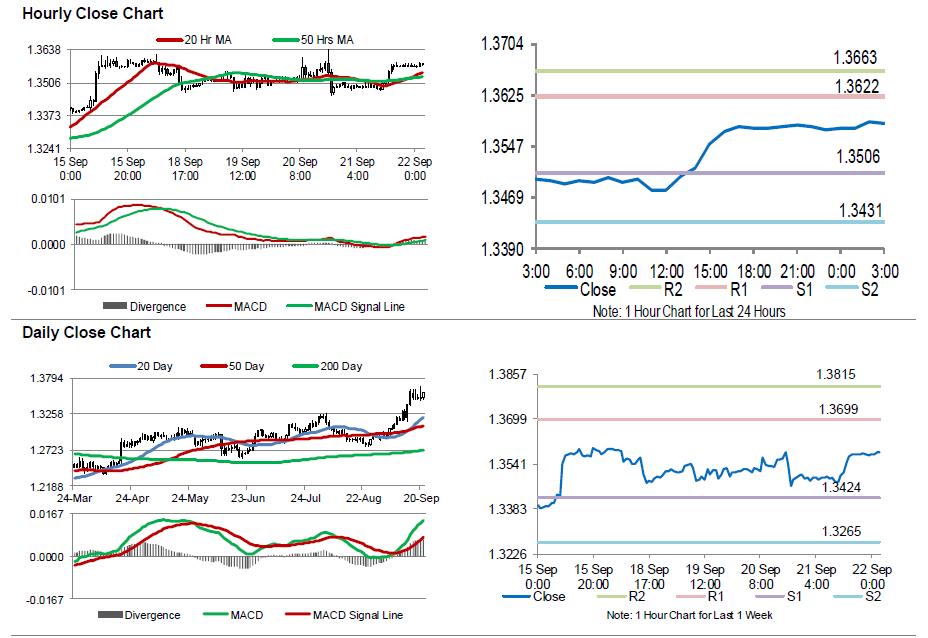

For the 24 hours to 23:00 GMT, the GBP rose 0.48% against the USD and closed at 1.3571.

On the macro front, Britain’s public sector net borrowing posted a less-than-expected deficit of £5.1 billion in August, following a revised surplus of £1.3 billion in the prior month. Investors had envisaged the public sector net borrowing to record a deficit of £6.4 billion.

In the Asian session, at GMT0300, the pair is trading at 1.3582, with the GBP trading 0.08% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3506, and a fall through could take it to the next support level of 1.3431. The pair is expected to find its first resistance at 1.3622, and a rise through could take it to the next resistance level of 1.3663.

Moving ahead, traders would eye a speech by the British Prime Minister, Theresa May, slated in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.