For the 24 hours to 23:00 GMT, the EUR rose 0.30% against the USD and closed at 1.0931.

On the macro front, Euro-zone’s preliminary consumer price inflation slowed to 0.9% on an annual basis in September, markings its lowest level in 3 years and compared to a level of 1.0% in the previous month. Market participants had anticipated the inflation to increase to a level of 1.0%. Meanwhile, the final manufacturing PMI dropped to its lowest level in 7-years a level of 45.7 in September, less than market expectations and preliminary figures for a fall to a level of 45.6. In the prior month, the PMI had registered a reading of 47.0 in the prior month.

Separately, in Germany, the final manufacturing PMI fell to a level of 41.7 in September, less than market consensus and preliminary figures for a reading of 41.4. In previous month, the PMI had recorded a reading of 43.5.

The US dollar declined against its major peers, amid dismal US manufacturing sector data.

In the US, data showed that ISM manufacturing activity index unexpectedly eased to a decade low level of 47.8 in October, amid prolonged trade tensions and defying market expectations for a rise to a level of 50.0. In the previous month, the index had recorded a level of 49.1. Further, the nation’s construction spending advanced 0.1% on a monthly basis in August, less than market expectations for a rise of 0.4%. In the preceding month, construction spending had recorded a revised flat reading. On the other hand, the final Markit manufacturing PMI rose to a 5-month high level of 51.1 in September, compared to a reading of 50.3 in the prior month. The preliminary figures had indicated an increase to a level of 51.0.

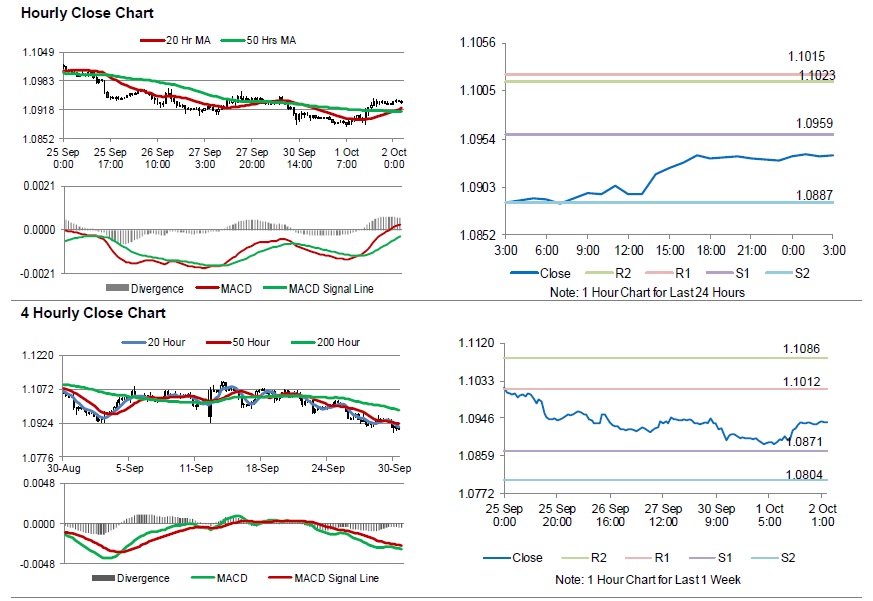

In the Asian session, at GMT0300, the pair is trading at 1.0937, with the EUR trading 0.05% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0959, and a fall through could take it to the next support level of 1.0887. The pair is expected to find its first resistance at 1.1023, and a rise through could take it to the next resistance level of 1.1015.

Amid lack of macroeconomic releases in the Euro-zone today, traders would await the US ADP employment change for September along with the MBA mortgage applications, set to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.