For the 24 hours to 23:00 GMT, the GBP slightly declined against the USD and closed at 1.2287.

Data indicated that UK’s seasonally adjusted Nationwide house price index unexpectedly eased 0.2% on a monthly basis in September, defying market consensus for a rise of 0.1%. The index had recorded a flat reading in the prior month. On the flipside, the Markit manufacturing PMI unexpectedly advanced to a level of 48.3 in September. In the previous month, the Markit manufacturing PMI had registered a reading of 47.4.

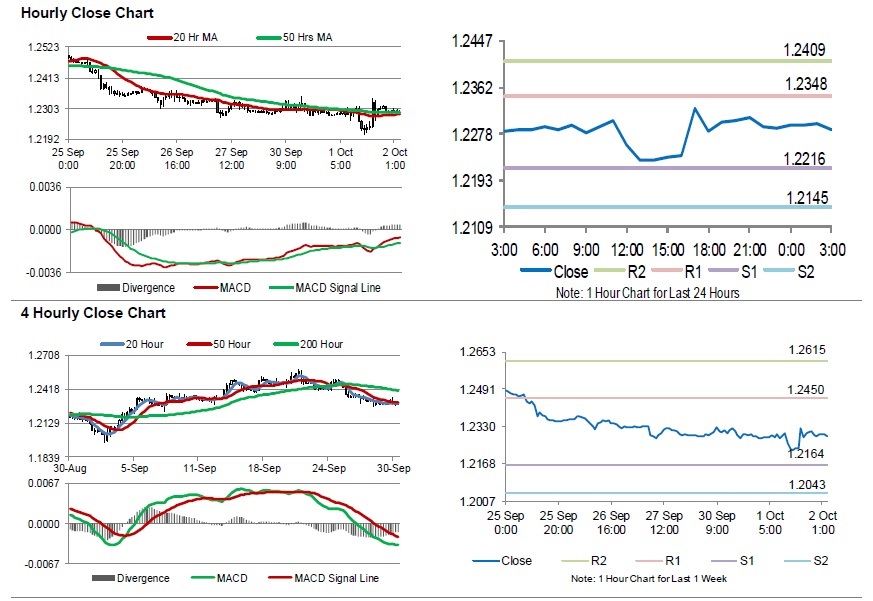

In the Asian session, at GMT0300, the pair is trading at 1.2286, with the GBP trading marginally lower against the USD from yesterday’s close.

Overnight data showed that the BRC shop price index dropped of 0.6% on a yearly basis in September, following a drop of 0.4% in the previous month.

The pair is expected to find support at 1.2216, and a fall through could take it to the next support level of 1.2145. The pair is expected to find its first resistance at 1.2348, and a rise through could take it to the next resistance level of 1.2409.

Looking ahead, traders would closely monitor UK’s Markit construction PMI for September, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.