For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.1045.

On the macro front, Euro-zone’s seasonally adjusted current account surplus widened to €20.6 billion in July, more than market expectations for a surplus of €20.3 billion. In the prior month, the nation had posted a revised surplus of €18.4 billion.

The Organization for Economic Cooperation and Development (OECD) in its biannual Economic Outlook reported that global economic growth will slow to 2.9% from 3.6% last year, amid US-China trade tensions and Brexit uncertainty. The organisation slashed Euro-zone’s economic growth forecast to 1.0% for 2019 and 2020. Moreover, the OECD cut its economic growth forecast for the US to 2.4% in 2019 and to 2.0% in 2020.

In the US, data showed that the Philadelphia Fed manufacturing index declined to a level of 12.0 in September, compared to a level of 16.8 in the prior month. Market participants had anticipated the index to fall to a level of 11.0. Further, leading indicator remained flat on a monthly basis in August. In the previous month, leading indicator had recorded a revised rise of 0.4%. Additionally, current account deficit narrowed to $128.2 billion in 2Q19, less than market expectations and compared to a revised deficit of $136.20 billion in the previous quarter.

Meanwhile, seasonally adjusted initial jobless claims advanced to a level of 208.0K in the week ended 14 September 2019, less than market anticipation for a rise to a level of 213.0K. Initial jobless claims had registered a revised reading of 206.0K in the previous week. Moreover, the US existing home sales unexpectedly rose to a 17-month high level of 1.3% on monthly basis to a level of 5.49 million in August, defying market consensus for a drop to a level of 5.37 million. Existing home sales had registered a level of 5.42 million in the previous month.

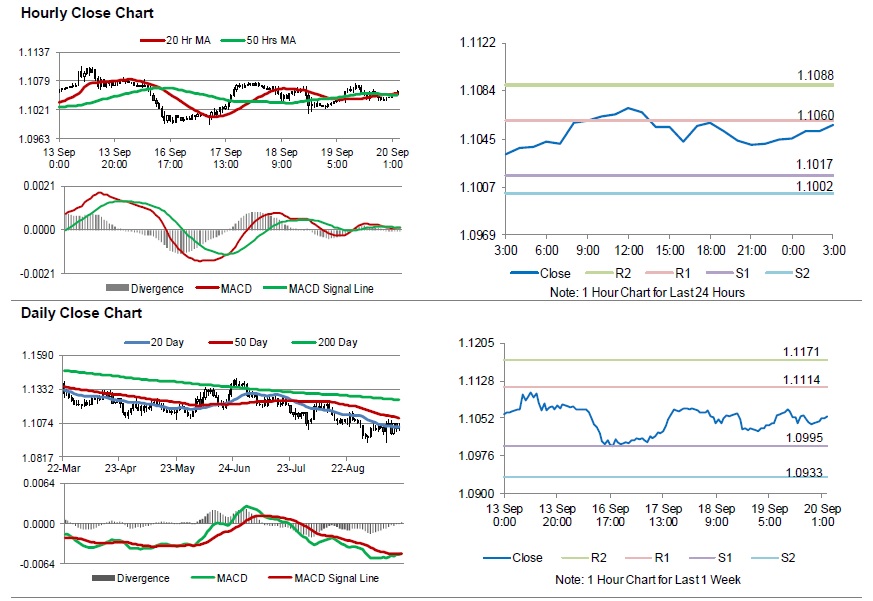

In the Asian session, at GMT0300, the pair is trading at 1.1057, with the EUR trading 0.11% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1017, and a fall through could take it to the next support level of 1.1002. The pair is expected to find its first resistance at 1.1060, and a rise through could take it to the next resistance level of 1.1088.

Going ahead, traders would await Euro-zone’s consumer confidence for September and Germany’s producer price index for August, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.