For the 24 hours to 23:00 GMT, the GBP rose 0.37% against the USD and closed at 1.2522, after the European Commission President, Jean-Claude Juncker, stated that a Brexit deal is possible before the deadline.

The Bank of England (BoE), in its policy meeting, unanimously voted to leave its key interest rates steady at 0.75%, as widely expected. However, the central bank warned that failure to reach a Brexit deal till October end would adversely impact the currency as well as damage economic growth. Meanwhile, the central downgraded UK’s economic growth forecast to 0.2% from 0.3% for the third quarter of 2019.

Data showed that UK’s retail sales advanced 2.7% on a yearly basis in August, following a revised rise 3.4% in the previous month.

The OECD, in its biannual economic outlook forecasted UK’s economy to grow 1.0% in 2019 and 0.9% in 2020, provided Britain leaves the European Union (EU) with deal. However, the economy would be 2% lower in 2020-21, if Britain leaves the EU without a deal

In the Asian session, at GMT0300, the pair is trading at 1.2546, with the GBP trading 0.19% higher against the USD from yesterday’s close.

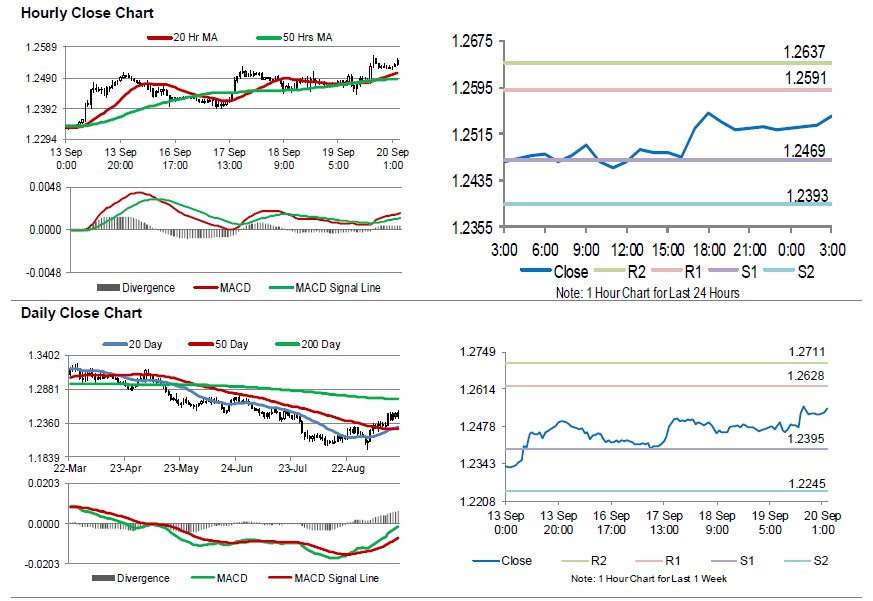

The pair is expected to find support at 1.2469, and a fall through could take it to the next support level of 1.2393. The pair is expected to find its first resistance at 1.2591, and a rise through could take it to the next resistance level of 1.2637.

Going ahead, investors would closely monitor UK’s public sector net borrowing and the BBA mortgage approvals, set to release next week.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.