For the 24 hours to 23:00 GMT, the EUR rose 0.72% against the USD and closed at 1.1823, after data showed that the Euro-zone’s seasonally adjusted industrial production unexpectedly rebounded 0.2% on a monthly basis in October, confounding market expectations for a flat reading. In the prior month, industrial production had dropped by a revised 0.5%.

Additionally, Germany’s final consumer price index (CPI) advanced 1.8% on an annual basis in November, confirming the preliminary print. The CPI had registered a gain of 1.6% in the prior month.

The greenback declined against its major counterparts, after the Federal Reserve (Fed) lifted its key interest rate, as widely expected, but left its outlook for 2018 interest rates hikes unchanged, amid persistently weak inflation.

The Fed, at its latest monetary policy meeting, voted 7-2 to raise its benchmark interest rate by a quarter percent point to a range of 1.25% to 1.50%, citing a tightening labour market and strengthening economy. Further, the central bank raised its US economic growth forecast to 2.5% in 2018, up from 2.1% estimated earlier, as officials expect a modest boost to the economy from the Trump administration’s possible fiscal stimulus. The central bank stuck to its projection of three rate hikes in 2018 and confirmed that it would step up the monthly pace of shrinking its balance sheet to $20.0 billion beginning in January.

On the economic front, consumer prices in the US increased 0.4% on a monthly basis in November, meeting market expectations and compared to an advance of 0.1% in the prior month.

On the other hand, the nation’s MBA mortgage applications retreated 2.3% in the week ended 08 December, following a rise of 4.7% in the prior week.

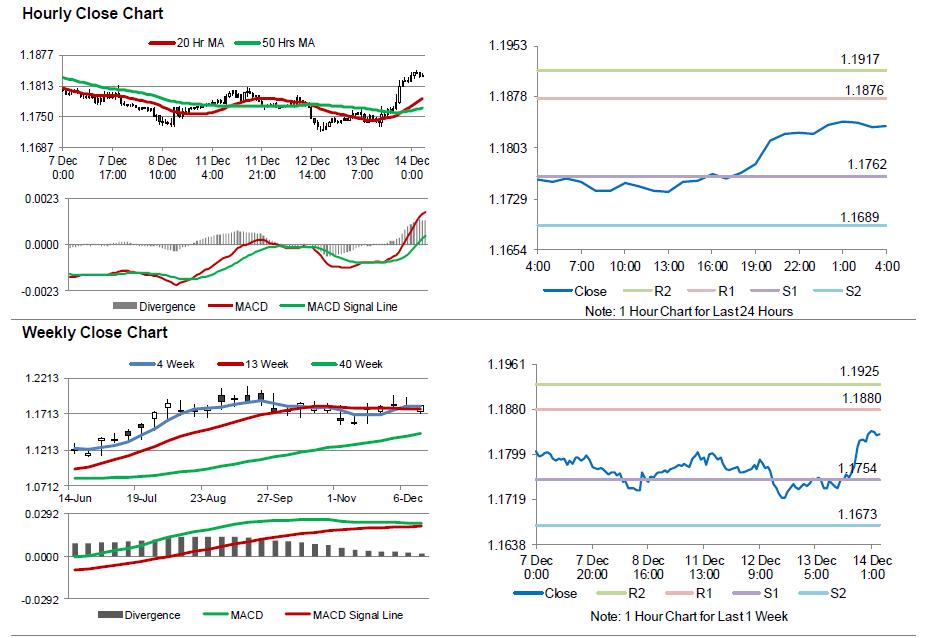

In the Asian session, at GMT0400, the pair is trading at 1.1835, with the EUR trading 0.1% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1762, and a fall through could take it to the next support level of 1.1689. The pair is expected to find its first resistance at 1.1876, and a rise through could take it to the next resistance level of 1.1917.

Moving ahead, investors would eye the European Central Bank’s (ECB) interest rate decision, scheduled later in the day. Additionally, the release of the flash Markit manufacturing and services PMIs for December across the Euro-zone, will keep investors on their toes. In the US, advance retail sales for November, the preliminary Markit manufacturing and services PMIs, both for December and the initial jobless claims data, due to release later in the day, will garner significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.