For the 24 hours to 23:00 GMT, the GBP rose 0.71% against the USD and closed at 1.3412, after data pointed to a pick-up in the UK wage growth.

Britain’s average earnings excluding bonus climbed more-than-expected by 2.3% on an annual basis in the August-October period, compared to a rise of 2.2% in the July-September period. Market had anticipated the nation’s average earnings excluding bonus to gain 2.2%.

However, the nation’s ILO unemployment rate unexpectedly remained unchanged at a 42-year low of 4.3% in the August-October period, while markets had envisaged for a drop to 4.2%. Moreover, the number of people employed in the nation declined by 56.0K in the three months to October, hitting its lowest in over two years. Market participants had expected the nation’s employment to ease 40.0K, after registering a decline of 14.0K in the July-September period.

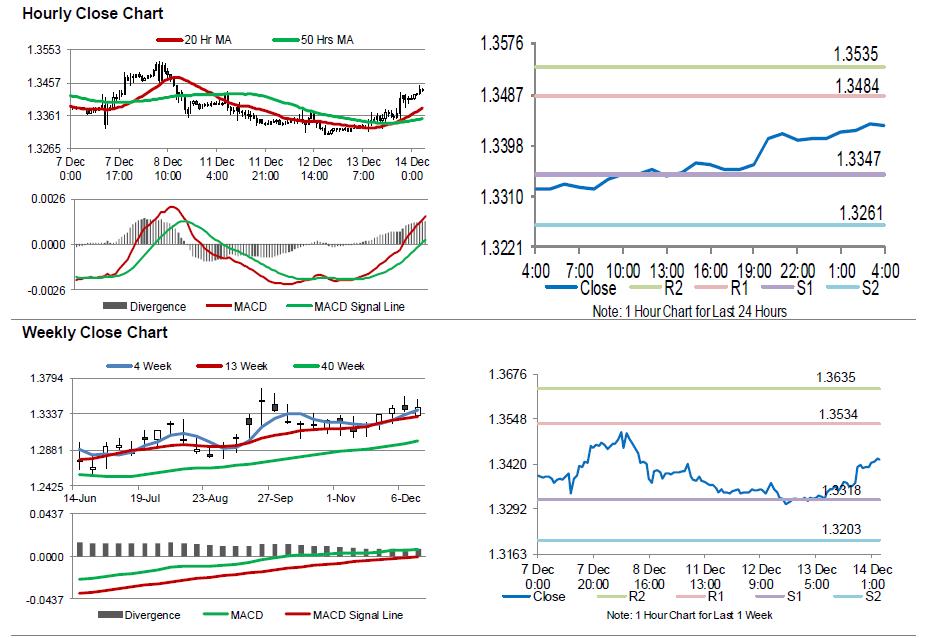

In the Asian session, at GMT0400, the pair is trading at 1.3433, with the GBP trading 0.16% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3347, and a fall through could take it to the next support level of 1.3261. The pair is expected to find its first resistance at 1.3484, and a rise through could take it to the next resistance level of 1.3535.

Trading trend in the Pound today is expected to be determined by the Bank of England’s (BoE) monetary policy decision, scheduled later in the day. Additionally, traders would focus on UK’s retail sales data for November, set to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.