For the 24 hours to 23:00 GMT, the EUR rose 0.24% against the USD and closed at 1.1240.

In economic news, the Euro-zone’s seasonally adjusted industrial production dropped by 1.1% MoM in July, pointing towards sluggish economic recovery in the Euro bloc. Industrial production recorded a revised advance of 0.8% in the previous month while markets anticipated a fall of 1.0%.

Data released in the US indicated that MBA mortgage applications advanced by 4.2% in the week ended 09 September 2016, following a rise of 0.9% in the prior week. On the other hand, the nation’s import price index slid more-than-expected by 0.2% on a monthly basis in August, falling for the first time since February 2016, compared to market expectations for a drop of 0.1% and after recording a gain of 0.1% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1246, with the EUR trading marginally higher against the USD from yesterday’s close.

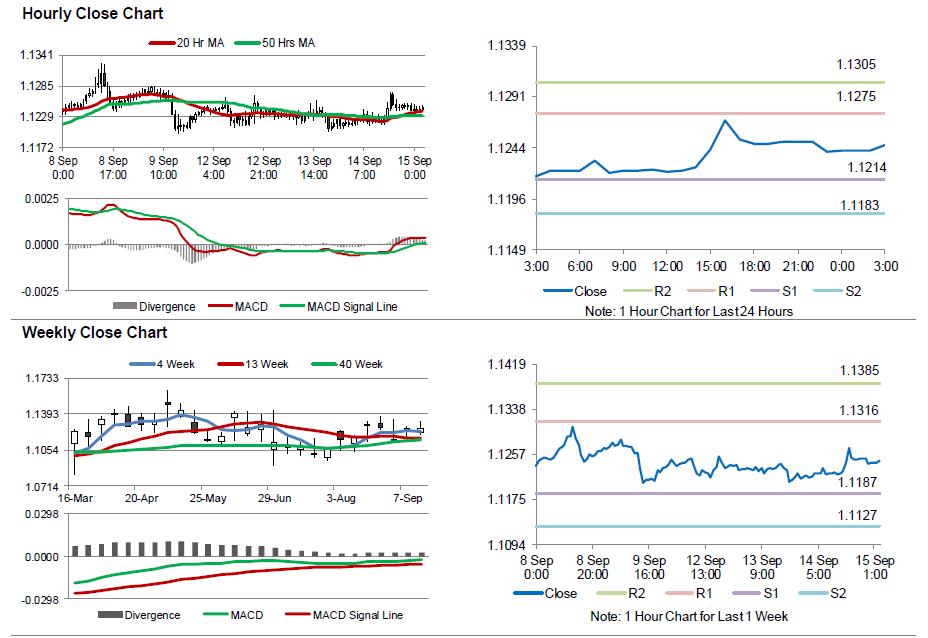

The pair is expected to find support at 1.1214, and a fall through could take it to the next support level of 1.1183. The pair is expected to find its first resistance at 1.1275, and a rise through could take it to the next resistance level of 1.1305.

Going ahead, market participants would keep a close watch on the Euro-zone’s consumer price index and trade balance data, both scheduled to release in a few hours. Moreover, the US advance retail sales, initial jobless claims, existing home sales and industrial production data, all slated to release later today, will attract significant amount of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.