For the 24 hours to 23:00 GMT, the GBP rose 0.43% against the USD and closed at 1.3249, after UK’s ILO unemployment rate remained steady at an eleven-year low level of 4.9% during the three months to July, in line with market expectations. However, the nation’s claimant count rose more-than-anticipated by 2.4K in August, after registering a decline of 3.6K in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3254, with the GBP trading a tad higher against the USD from yesterday’s close.

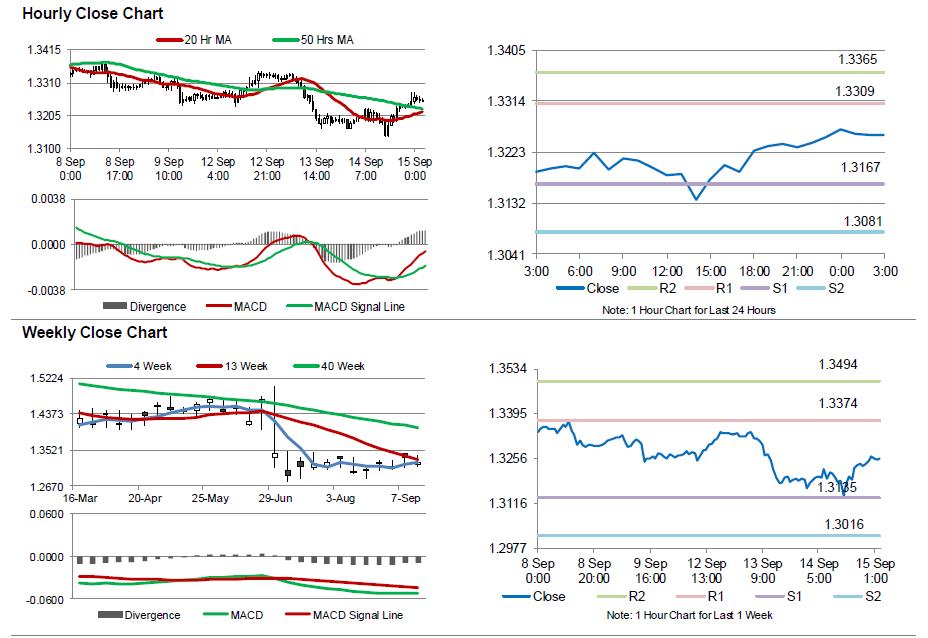

The pair is expected to find support at 1.3167, and a fall through could take it to the next support level of 1.3081. The pair is expected to find its first resistance at 1.3309, and a rise through could take it to the next resistance level of 1.3365.

Investors would closely monitor the BoE’s interest rate decision, due to release in a few hours. The central bank is expected to hold interest rate at the record low level of 0.25%.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.