For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.1029.

On the macro front, Euro-zone’s consumer price inflation slowed more-than-expected to 0.7% in March, amid fall in energy prices. In the previous month, consumer price inflation had recorded a level of 1.2%. Separately, Germany’s seasonally adjusted unemployment rate unexpectedly remained unchanged at 5.0% in March, defying market forecast for a rise to 5.1%.

In the US, the Chicago Purchasing Managers’ Index dropped to a level of 47.8 in March, less than market expectations for a fall to 40.0 and compared to a reading of 49.0 in the prior month. Meanwhile, the consumer confidence index slumped to a level of 120.0 in March. In the prior month, the consumer confidence index had recorded a revised reading of 132.6.

In the Asian session, at GMT0300, the pair is trading at 1.1023, with the EUR trading 0.05% lower against the USD from yesterday’s close.

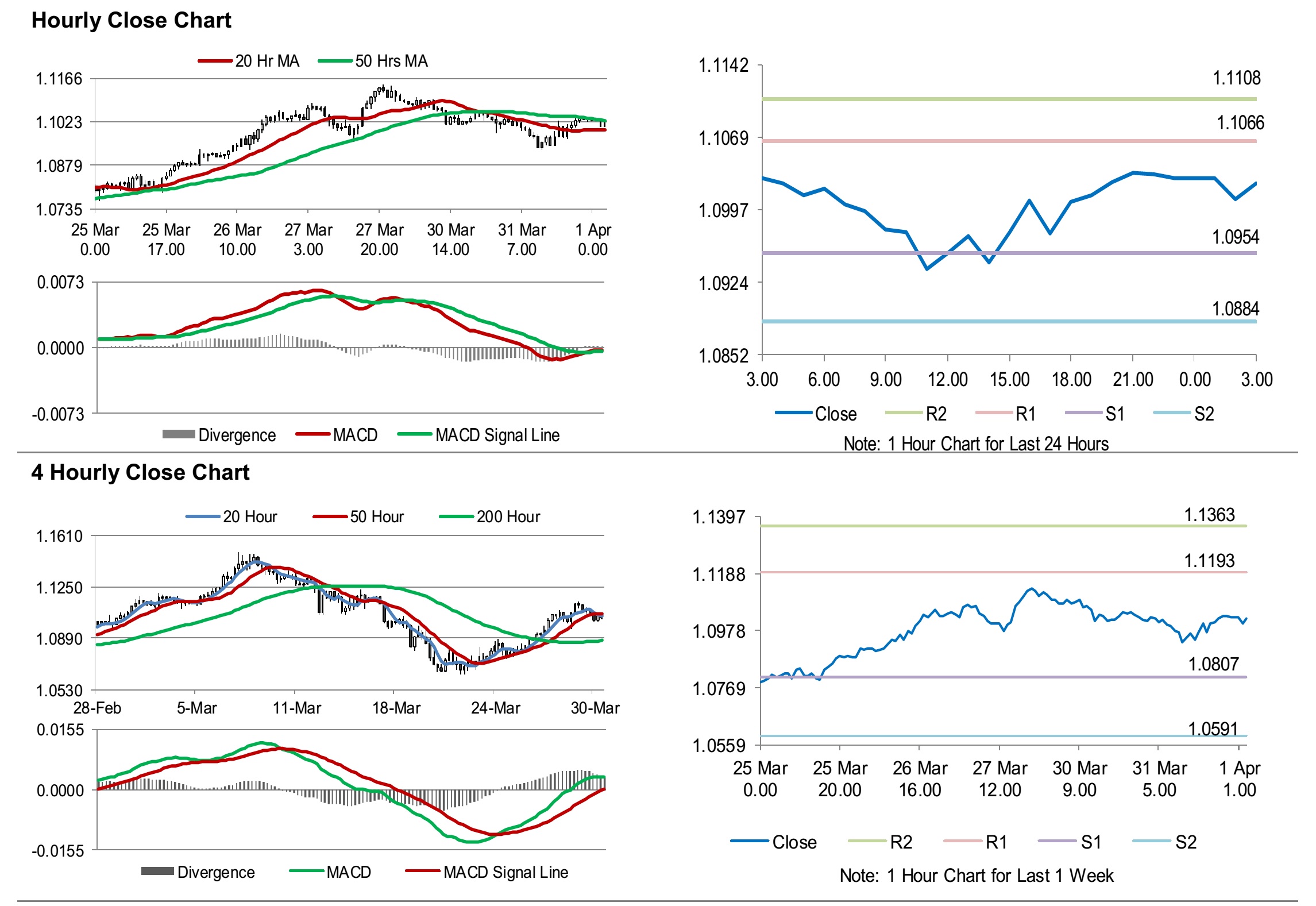

The pair is expected to find support at 1.0954, and a fall through could take it to the next support level of 1.0884. The pair is expected to find its first resistance at 1.1066, and a rise through could take it to the next resistance level of 1.1108.

Looking ahead, market participants would keep close a watch on the Markit manufacturing PMIs for March, slated to release across the euro area. Additionally, Euro-zone’s unemployment rate and Germany’s retail sales, both for February, would keep investors on their toes. Later in the day, the US Markit manufacturing PMI and the ISM manufacturing PMI, both for March along with construction spending for February, as well as the MBA mortgage applications, would garner significant amount of investor attention.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.