For the 24 hours to 23:00 GMT, the GBP declined 4.76% against the USD and closed at 1.2408.

On the data front, UK’s gross domestic product (GDP) remained flat on a quarterly basis in the fourth quarter of 2019, in line with market forecast and compared to a rise of 0.4% in the previous quarter. The preliminary figures had also indicated an unchanged reading 0%. Moreover, current account deficit narrowed to £5.6 billion in the fourth quarter of 2019, more than market consensus for a deficit of £7.0 billion and compared to a deficit of £19.9 billion in the earlier month. Moreover, the BRC shop price index fell 0.8% on a yearly basis in February, In the previous month, the BRC shop price index had recorded a drop of 0.6%.

In the Asian session, at GMT0300, the pair is trading at 1.2394, with the GBP trading 0.11% lower against the USD from yesterday’s close.

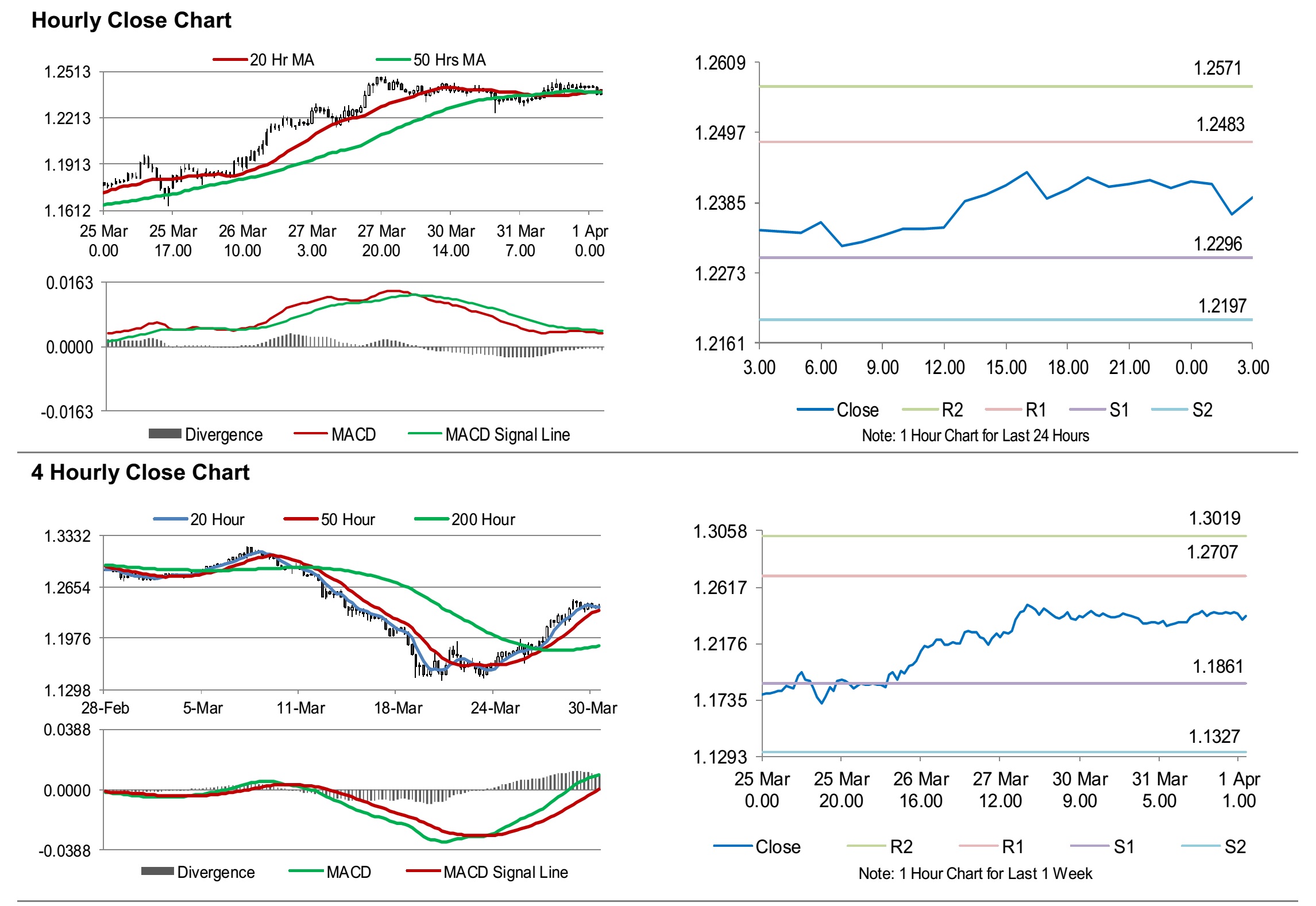

The pair is expected to find support at 1.2296, and a fall through could take it to the next support level of 1.2197. The pair is expected to find its first resistance at 1.2483, and a rise through could take it to the next resistance level of 1.2571.

Moving ahead, traders would keep a watch on Britain’s Markit manufacturing PMI for March, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.