For the 24 hours to 23:00 GMT, the EUR declined 0.74% against the USD and closed at 1.0535.

On the economic front, the Euro-zone’s preliminary Markit manufacturing PMI unexpectedly climbed to a level of 55.5 in February, expanding at its fastest pace in nearly six-years, thus pointing to a strong first quarter growth in the common currency region. Markets expected the PMI to drop to a level of 55.0, following a reading of 55.2 in the previous month. Moreover, the nation’s services sector unexpectedly surged to a more than five-year high level of 55.6 in February, compared to a level of 53.7 in the prior month and defying investor consensus for the PMI to record a steady reading.

Separately, Germany’s manufacturing sector growth surprised with the fastest rate of expansion in nearly 7-years, after it advanced to a level of 57.0 in February, boosting optimism over the health of the nation’s economy. Meanwhile, market anticipated the PMI to drop to a level of 56.0, following a level of 56.4 in the previous month. Further, activity in the nation’s services sector jumped more-than-expected to a level of 54.4 in February, notching its highest level in three-months and after recording a level of 53.4 in the previous month, whereas investors had envisaged the PMI to climb to a level of 53.6.

The greenback gained ground against a basket of major currencies, after hawkish comments from the Philadelphia Fed President, Patrick Harker, stating that he would support an interest rate increase at the central bank’s next meeting in March, if the economy gains further momentum.

However, gains in the greenback were capped, after fresh data indicated sluggish economic growth in the US, thus dampening optimism over the nation’s economic outlook.

Data revealed that the US flash Markit manufacturing PMI unexpectedly declined to a two-month low level of 54.3 in February, compared to a reading of 55.0 in the prior month, while markets were expecting the PMI to advance to a level of 55.2. Additionally, the nation’s services sector activity expanded at its slowest pace in two-months, after it fell to a level of 53.9 in February, compared to a level of 55.6 in the prior month, whereas market participants were expecting the PMI to climb to a level of 55.8.

In the Asian session, at GMT0400, the pair is trading at 1.0544, with the EUR trading 0.09% higher against the USD from yesterday’s close.

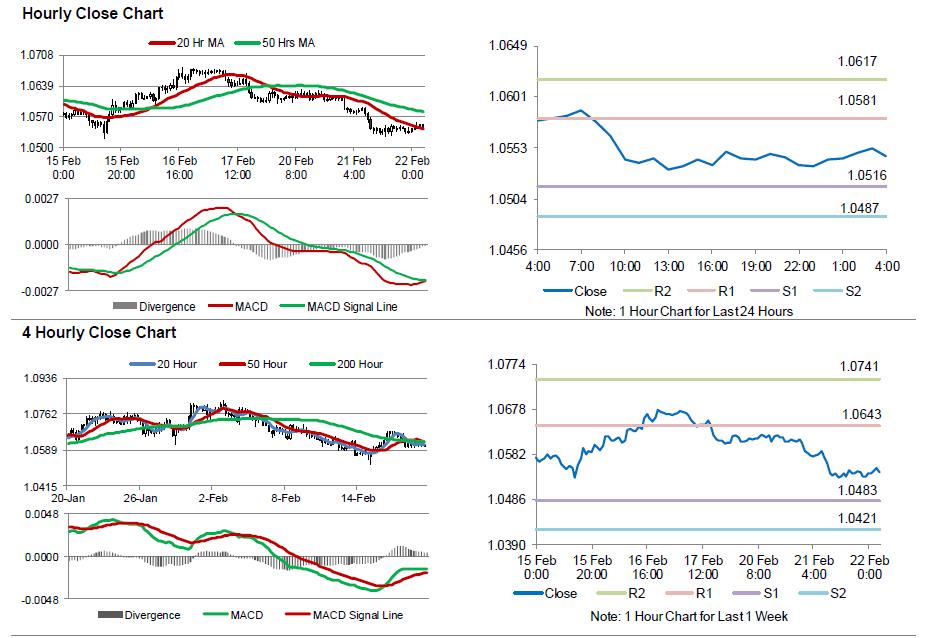

The pair is expected to find support at 1.0516, and a fall through could take it to the next support level of 1.0487. The pair is expected to find its first resistance at 1.0581, and a rise through could take it to the next resistance level of 1.0617.

Moving ahead, traders would keep a close watch on the Euro-zone’s final consumer price index for January, along with Germany’s Ifo survey data for February, scheduled to release in a few hours. Additionally, investors will look forward to minutes of the US Fed’s latest meeting, slated to release later in the day, for clues on the trajectory of future interest rate hikes. Moreover, the US existing home sales for January and MBA mortgage applications data, will also pique significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.