For the 24 hours to 23:00 GMT, the GBP rose 0.08% against the USD and closed at 1.2476, after data indicated that Britain’s public sector net borrowing posted a surplus of £9.8 billion in January, recording its first surplus since July 2016. Public sector net borrowing posted a revised deficit of £4.2 billion in the prior month, whereas markets were expecting for a surplus of £14.4 billion.

In the Asian session, at GMT0400, the pair is trading at 1.2496, with the GBP trading 0.16% higher against the USD from yesterday’s close.

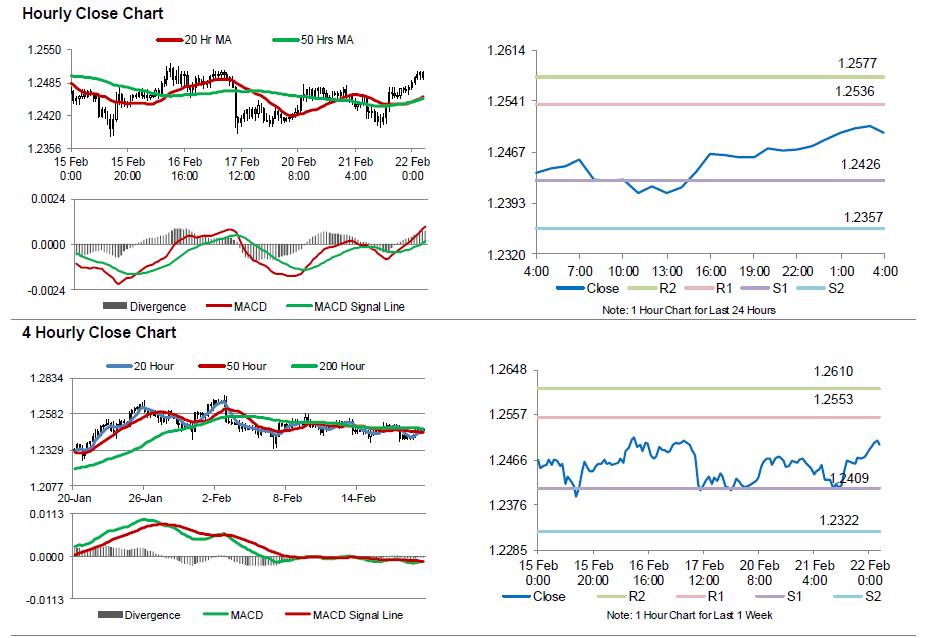

The pair is expected to find support at 1.2426, and a fall through could take it to the next support level of 1.2357. The pair is expected to find its first resistance at 1.2536, and a rise through could take it to the next resistance level of 1.2577.

Moving ahead, market participants will focus on UK’s flash 4Q GDP data, due to release in a few hours, to get better insights into the nation’s economy.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.