For the 24 hours to 23:00 GMT, the EUR rose 0.08% against the USD and closed at 1.1138.

On the data front, Euro-zone’s flash manufacturing PMI unexpectedly fell to a 2-month low level of 45.9 in December, defying market consensus for a rise to a level of 47.1. In the prior month, the PMI had recorded a reading of 46.9. Meanwhile, the region’s preliminary services PMI advanced to 52.4 in December, beating market expectations for an increase to a level of 52.0. In the preceding month, the PMI had registered a level of 51.9.

Separately, in Germany, the manufacturing PMI unexpectedly dropped to a level of 43.4 in December, defying market anticipations for a rise to a level of 44.5. In the prior month, the PMI had recorded a reading of 44.1. However, the nation’s preliminary services PMI rose to a level of 52.00 in December, in line with market expectations. In the previous month, the PMI had recorded a reading of 51.7.

In the US, data showed that the NY Empire State manufacturing index climbed to 3.5 in December, compared to 2.9 in the previous month. Moreover, the nation’s NAHB housing market index unexpectedly advanced to a 20-year high level of 76.0 in December, confounding market consensus for a fall to a level of 70.0. In the preceding month, the index had recorded a revised level of 71.0. Further, the nation’s flash Markit services PMI unexpectedly increased to a level of 52.2 in December, compared to a level of 51.6 in the previous month. Markets had anticipated the PMI to drop to a level of 51.4. On the other hand, the US preliminary Markit manufacturing PMI eased to a level of 52.5 in December, compared to a level of 52.6 in the prior month. Market participants had envisaged the PMI to decline to a level of 52.4.

In the Asian session, at GMT0400, the pair is trading at 1.1146, with the EUR trading 0.07% higher against the USD from yesterday’s close.

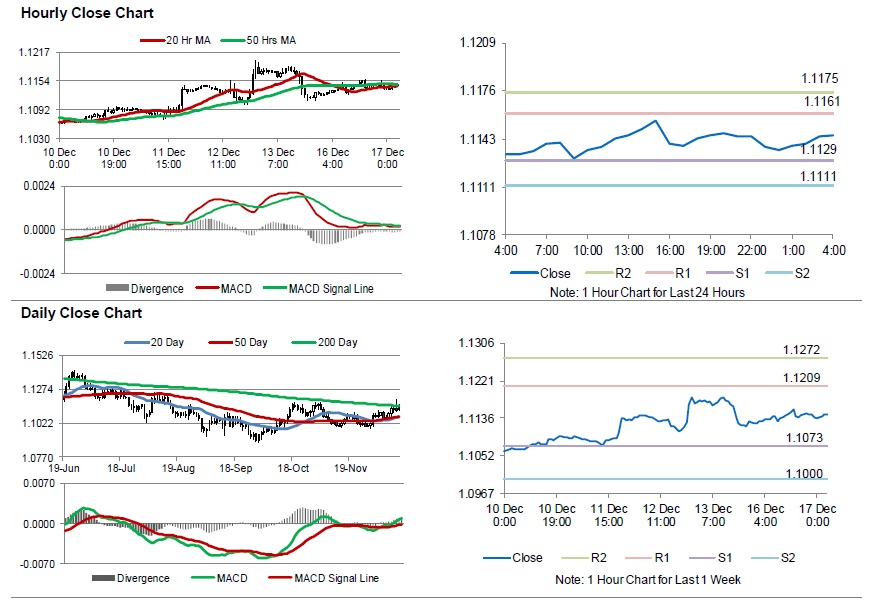

The pair is expected to find support at 1.1129, and a fall through could take it to the next support level of 1.1111. The pair is expected to find its first resistance at 1.1161, and a rise through could take it to the next resistance level of 1.1175.

Looking ahead, traders would keep an eye on Euro-zone’s trade balance data for October, slated to release in a few hours. Later in the day, the US JOLTS job openings for October, building permits, housing starts and industrial production, all for November, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.