For the 24 hours to 23:00 GMT, the GBP declined 0.79% against the USD and closed at 1.3283, following reports that Britain’s Prime Minister Boris Johnson is likely to delay Brexit deadline to 31 December 2020.

In economic news, UK’s flash manufacturing PMI unexpectedly declined to a level of 47.4 in December, marking its lowest level in 41 months and defying market expectations for a rise to a level of 49.4. In the previous month, the PMI had recorded a reading of 48.9. Moreover, the nation’s services PMI unexpectedly eased to a level of 49.0 in December, cofounding market anticipations for an increase to a level of 49.6. In the prior month, the PMI had registered a reading of 49.3.

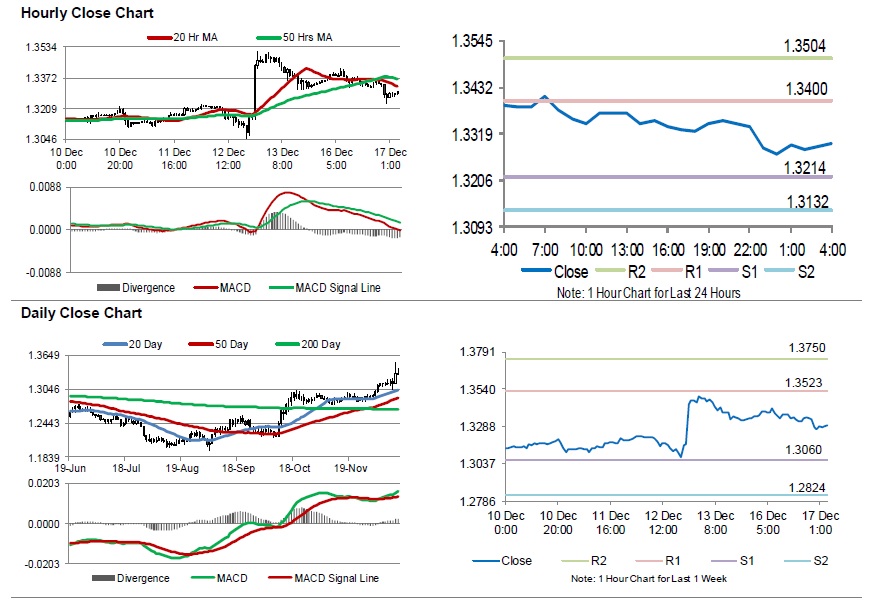

In the Asian session, at GMT0400, the pair is trading at 1.3296, with the GBP trading 0.10% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.3214, and a fall through could take it to the next support level of 1.3132. The pair is expected to find its first resistance at 1.3400, and a rise through could take it to the next resistance level of 1.3504.

Trading trend in the Sterling today, is expected to be determined by UK’s ILO unemployment rate and the CBI industrial trends survey for December, set to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.