For the 24 hours to 23:00 GMT, the EUR declined 1.07% against the USD and closed at 1.0419.

In economic news, the Euro-zone’s flash Markit manufacturing PMI unexpectedly rose to a level of 54.9 in December, advancing at the fastest pace since April 2011, thus pointing towards solid economic growth in the region. Markets anticipated the manufacturing PMI to remain steady at a level of 53.7, recorded in the preceding month. Meanwhile, growth in the region’s services sector surprisingly slowed to a level of 53.1 in December, while markets were expecting services PMI to record a steady reading of 53.8.

Moreover, in Germany, the preliminary Markit manufacturing PMI advanced more-than-expected to a level of 55.5 in December, expanding at the fastest pace in three years, compared to market expectations of an advance to a level of 54.5 and after recording a level of 54.3 in the prior month. However, activity in the nation’s services sector slowed to its lowest level in three months, after the flash Markit services PMI fell more-than-expected to a level of 53.8 in December, against market expectations of a drop to a level of 54.9 and after registering a reading of 55.1 in the previous month.

The US Dollar surged against a broader basket of currencies, as investors continued to cheer an unexpectedly hawkish note of the US Federal Reserve on future path of interest rate hikes.

In economic news, the US consumer price index rose 0.2% on a monthly basis in November, at par with market expectations, rising for the fourth consecutive month and adding to evidence that inflation is gradually approaching the central bank’s goal. In the previous month, the consumer price index had advanced 0.4%. Further, the nation’s initial jobless claims dropped more-than-expected to a level of 254.0K in the week ended 10 December 2016, highlighting strength in the nation’s labour market. Initial jobless claims had registered a reading of 258.0K in the previous week. Also, the nation’s NAHB housing market index unexpectedly surged to its highest level in eleven years of 70.0 in December, boosted by increasing optimism under the presidency of Donald Trump. Markets expected the index to remain steady at 63.0, recorded in the previous month.

In other economic news, the nation’s flash Markit manufacturing PMI advanced to its highest level in 21-months, after it edged up to a level of 54.2 in December, falling short of market expectations of a rise to 54.5 and following a reading of 54.1 in the previous month. Moreover, the nation’s Philadelphia Fed manufacturing index jumped to its highest level in two years to 21.5 in December, while the New York Empire State manufacturing index soared to a level of 9.0 in December, notching its strongest reading since April 2016.

In the Asian session, at GMT0400, the pair is trading at 1.0430, with the EUR trading 0.11% higher from yesterday’s close.

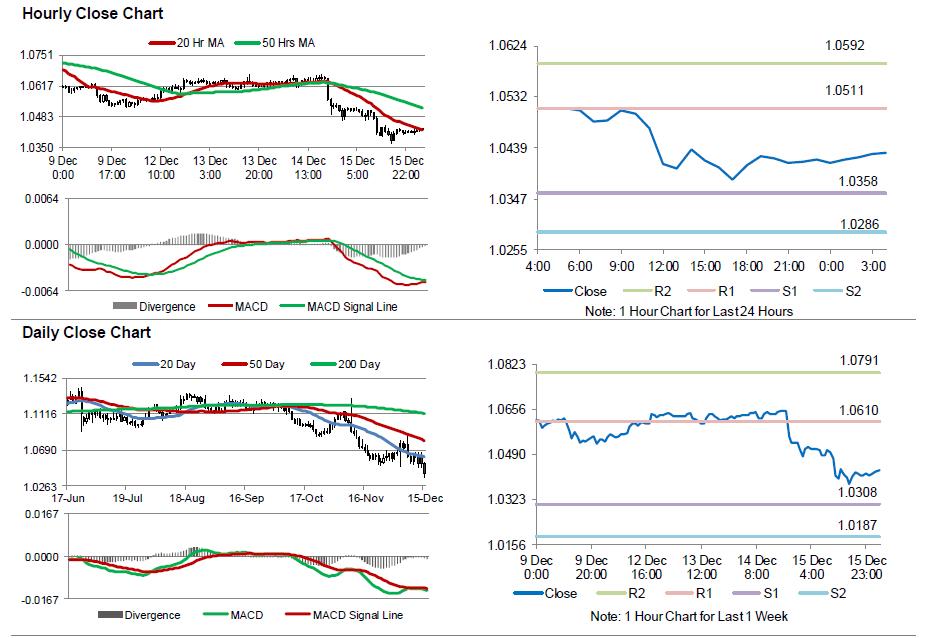

The pair is expected to find support at 1.0358, and a fall through could take it to the next support level of 1.0286. The pair is expected to find its first resistance at 1.0511, and a rise through could take it to the next resistance level of 1.0592.

Going ahead, investors will look forward to the Euro-zone’s consumer price index for November and trade balance for October, slated to release in a few hours. Moreover, the US housing starts and building permits, both for November, scheduled to release later today would garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.