For the 24 hours to 23:00 GMT, the GBP declined 0.92% against the USD and closed at 1.2424, after minutes of the Bank of England’s (BoE) latest monetary policy meeting indicated that inflation may not rise as quickly as it expected in the near-term.

The BoE, in its latest monetary policy meeting, held the benchmark interest rate steady at record low level of 0.25%, as was widely expected and maintained the current asset purchase programme at £435.0 billion, but warned that the balance of risks around inflation and growth would force the central bank to respond “in either direction” next year. Minutes of the meeting indicated that UK’s economic growth had been “remarkably steady” since the Brexit vote, but growth in 2017 is set to falter as firms put investment decisions on hold. The central bank also warned that inflation may not rise as quickly as it expected in the near-term.

In other economic news, UK’s retail sales unexpectedly climbed 0.2% MoM in November, compared to a revised rise of 1.8% in the previous month, whereas markets anticipated retail sales to remain flat.

In the Asian session, at GMT0400, the pair is trading at 1.2409, with the GBP trading 0.12% lower from yesterday’s close.

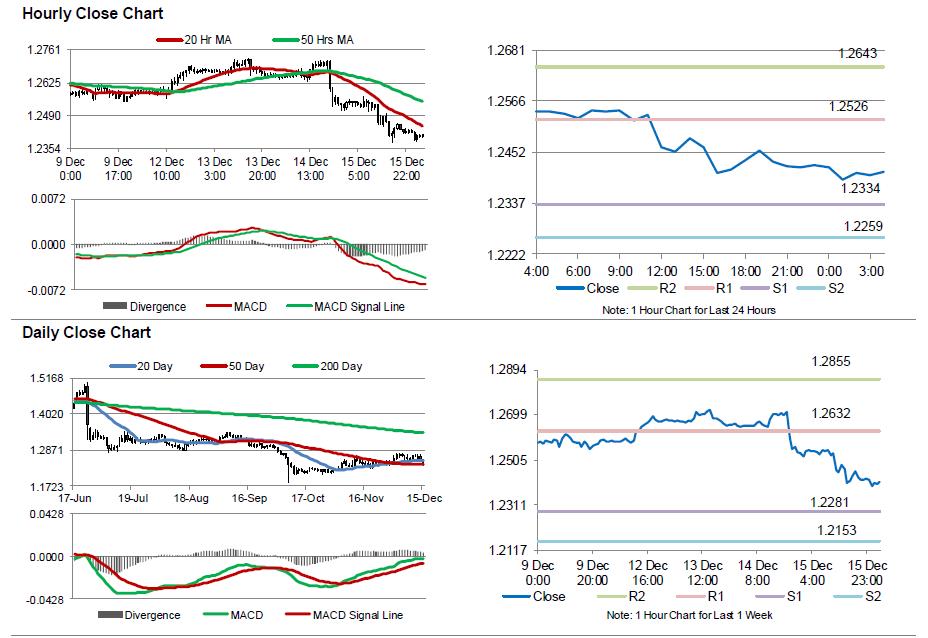

The pair is expected to find support at 1.2334, and a fall through could take it to the next support level of 1.2259. The pair is expected to find its first resistance at 1.2526, and a rise through could take it to the next resistance level of 1.2643.

Moving ahead, market participants would await the release of BoE’s quarterly bulletin report, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.