For the 24 hours to 23:00 GMT, the EUR rose 0.73% against the USD and closed at 1.2506.

On the macro front, the Euro-zone final Markit manufacturing PMI eased to a level of 59.6 in January, confirming the preliminary print. In the previous month, the PMI had registered a reading of 60.6.

Separately, Germany’s final Markit manufacturing PMI declined to a level of 61.1 in January, higher than a preliminary print indicating a fall to a level of 61.2. The PMI had registered a reading of 63.3 in the previous month.

In the US, data indicated that the ISM manufacturing PMI dropped less-than-anticipated to a level of 59.1 in January, compared to a revised level of 59.3 in the prior month. Markets were expecting the PMI to fall to a level of 58.6. Meanwhile, the nation’s final Markit manufacturing PMI rose as initially estimated to a level of 55.5 in January, compared to a reading of 55.1 in the prior month.

Another set of data showed that construction spending in the US climbed 0.7% on a monthly basis in December, exceeding market expectations for an advance of 0.4%, as investment in private construction projects jumped to a record high. Construction spending had gained by a revised 0.6% in the prior month. Furthermore, the nation’s initial jobless claims unexpectedly fell to a level of 230.0K in the week ended 27 January, confounding market estimates for a rise to a level of 235.0K and pointing to a vibrant labour market. In the prior week, initial jobless claims had registered a revised reading of 231.0K.

In the Asian session, at GMT0400, the pair is trading at 1.2498, with the EUR trading 0.06% lower against the USD from yesterday’s close.

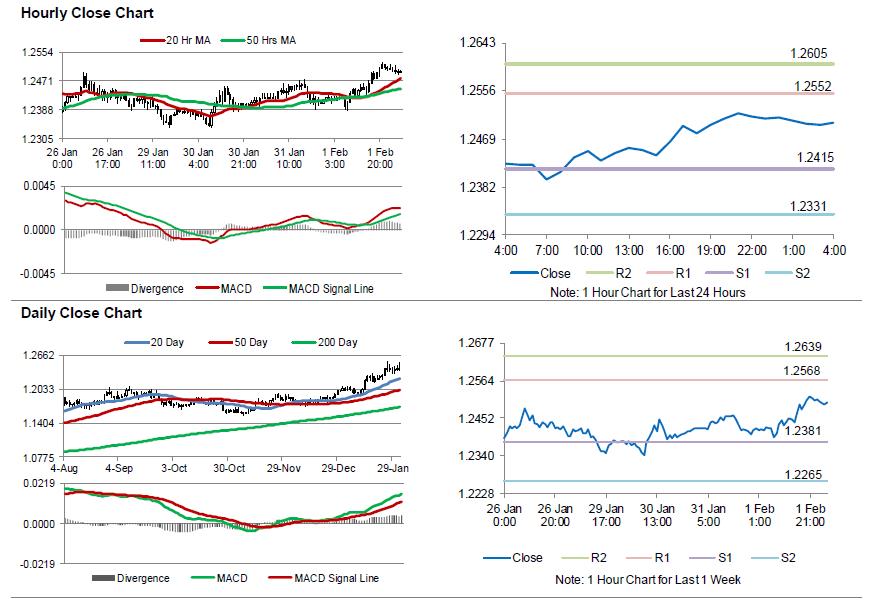

The pair is expected to find support at 1.2415, and a fall through could take it to the next support level of 1.2331. The pair is expected to find its first resistance at 1.2552, and a rise through could take it to the next resistance level of 1.2605.

With no key macroeconomic releases in the Euro-zone today, investors would turn their attention to the crucial US non-farm payrolls and unemployment rate data, both for January, scheduled to release later in the day. Additionally, the nation’s final durable goods orders and factory orders for December as well as the final Michigan consumer sentiment index for January, will be eyed by traders.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.