For the 24 hours to 23:00 GMT, the GBP rose 0.49% against the USD and closed at 1.4263, brushing off data showing an unexpected drop in Britain’s manufacturing sector.

Data showed that UK’s Markit manufacturing PMI registered an unexpected drop to a level of 55.3 in January, hitting its lowest level in 7 months, indicating that the sector lost momentum after a strong performance in recent months. In the prior month, the PMI had registered a revised level of 56.2, while investors had envisaged for an advance to a level of 56.5.

Other data indicated that Britain’s seasonally adjusted Nationwide house prices rose more-than-estimated by 0.6% MoM in January, compared to a similar rise in the prior month. Market participants had anticipated for a gain of 0.1%.

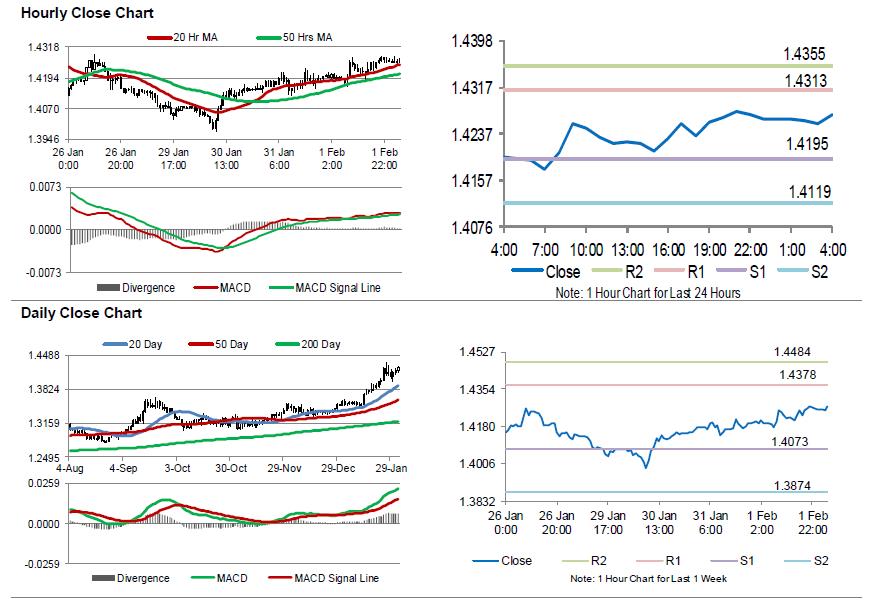

In the Asian session, at GMT0400, the pair is trading at 1.4272, with the GBP trading 0.06% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.4195, and a fall through could take it to the next support level of 1.4119. The pair is expected to find its first resistance at 1.4313, and a rise through could take it to the next resistance level of 1.4355.

Looking ahead, traders would keep a close watch on UK’s Markit construction PMI for January, due to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.