For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.1152.

On the data front, Euro-zone’s seasonally adjusted trade surplus widened to €24.5 billion in October, from a revised surplus of €18.7 billion in the previous month. Market participants had expected the nation to post a surplus of €19.3 billion.

In the US, data showed that the housing starts advanced 3.2% on a monthly basis to an annual rate of 1365.0K in November, surpassing market consensus for a reading of 1340.0K. The housing starts had registered a revised level of 1323.0K in the previous month. Moreover, the nation’s building permits unexpectedly rose 1.4% on a monthly basis to an annual rate of 1482.0K, marking its highest level since 2007 and defying market anticipations for a fall to a level of 1410.0K. In the prior month, building permits had recorded a level of 1461.0K. Additionally, the US JOLTs job openings climbed to a level of 7267.0K in October, rebounding from an 18-month low level and higher than market expectations for a rise to a level of 7111.0K. The JOLTs job openings had recorded a revised reading of 7032.0K in the prior month. Also, the US industrial production increased 1.1% on a monthly basis in November, higher than market expectations for a rise of 0.8%. In the previous month, industrial production had recorded a revised drop of 0.9%. Further, manufacturing production climbed 1.1% on a monthly basis in November. In the prior month, manufacturing production had registered a revised drop of 0.7%.

In the Asian session, at GMT0400, the pair is trading at 1.1133, with the EUR trading 0.17% lower against the USD from yesterday’s close.

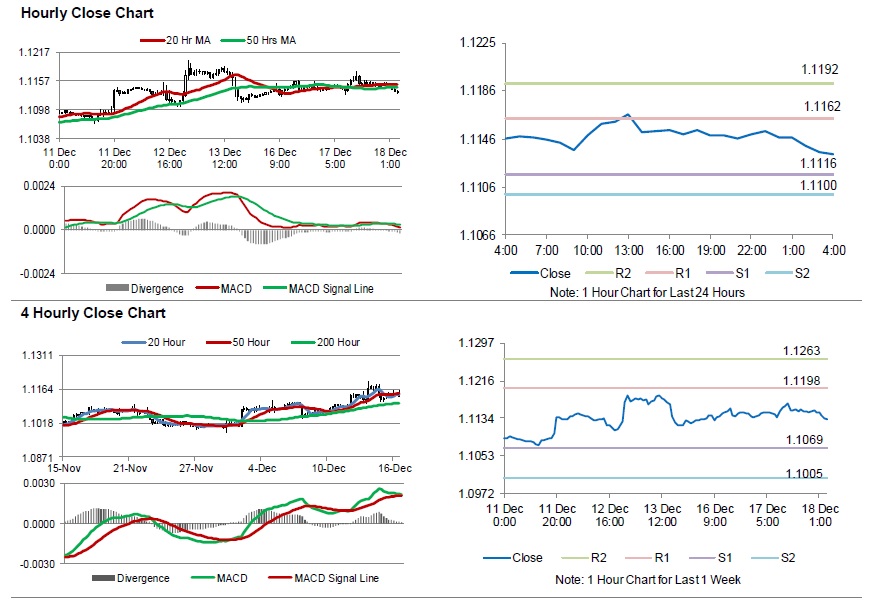

The pair is expected to find support at 1.1116, and a fall through could take it to the next support level of 1.1100. The pair is expected to find its first resistance at 1.1162, and a rise through could take it to the next resistance level of 1.1192.

Going forward, traders would keep an eye on Euro-zone’s consumer price index for November and construction output, both for October, slated to release in a few hours. Later in the day, the US MBA mortgage applications will be on investors radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.