For the 24 hours to 23:00 GMT, the GBP declined 1.14% against the USD and closed at 1.3131, after Prime Minister, Boris Johnson’s hard line in talks with the European Union stoked fears of a hard Brexit.

Data showed that UK’s ILO unemployment rate remained steady at 3.8% in the three months ended October, remaining at a 45-year low and defying market anticipation for a rise to 3.9%. Meanwhile, the nation’s CBI trends selling prices improved to a level of 6.0 in December, compared to a level of -1.0 in the previous month.

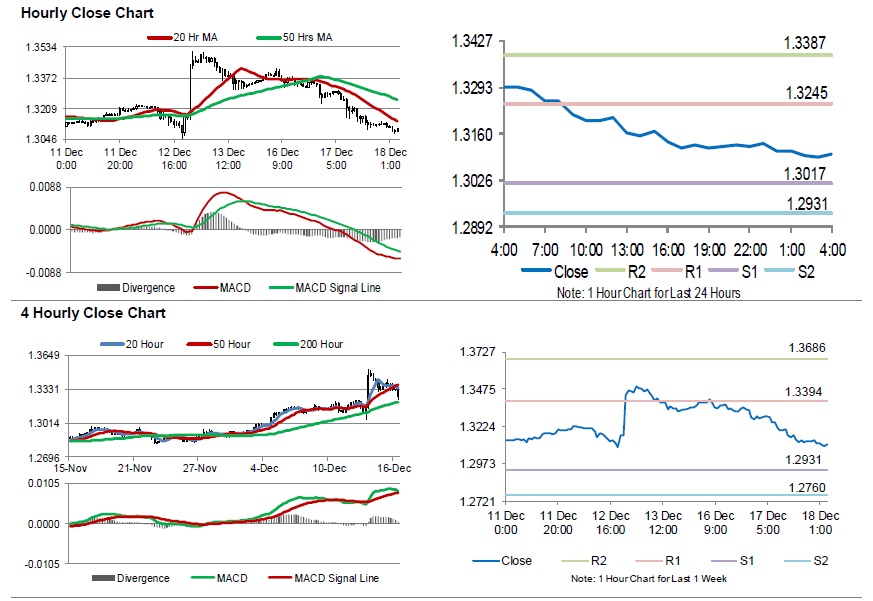

In the Asian session, at GMT0400, the pair is trading at 1.3103, with the GBP trading 0.21% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3017, and a fall through could take it to the next support level of 1.2931. The pair is expected to find its first resistance at 1.3245, and a rise through could take it to the next resistance level of 1.3387.

Trading trend in the Sterling today, is expected to be determined by UK’s consumer price index, producer price index and retail price index, all for November along with house price index for October, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.