For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.0592, after the Euro-zone’s seasonally adjusted trade surplus surprisingly widened to a level of €24.5 billion in December, from a revised trade surplus of €22.2 billion in the prior month, while investors had envisaged the region to register a trade surplus of €22.0 billion.

In the US, data indicated that the consumer price index (CPI) jumped 0.6% on a monthly basis in January, rising at the fastest pace in nearly four years and beating market expectations for an advance of 0.3%, thus suggesting that inflation pressures may be picking-up in the world’s largest economy. The CPI had recorded a rise of 0.3% in the prior month. Further, the nation’s advance retail sales advanced more-than-expected by 0.4% on a monthly basis in January, reinforcing views that consumer demand will remain one of the pillars for economic growth in the first quarter of 2017. Meanwhile, markets anticipated advance retail sales to rise 0.1%, following a revised gain of 1.0% in the previous month. Also, the nation’s manufacturing production rose 0.2% MoM in January, meeting market expectations. In the previous month, manufacturing production had registered a similar rise. Additionally, business inventories registered a rise of 0.4% in December, at par with market consensus and following a revised gain of 0.8% in the previous month.

In other economic news, the US industrial production unexpectedly fell 0.3% MoM in January, recording its largest decline since September 2016, as unseasonably warm temperatures reduced demand for utilities. Industrial production registered a revised rise of 0.6% in the prior month, while market expected it to record a flat reading. Moreover, the NAHB housing market index unexpectedly dropped to a level of 65.0 in February, confounding market consensus for an unchanged reading. The index had recorded a level of 67.0 in the previous month. Additionally, the nation’s MBA mortgage applications dropped 3.7% in the week ended 10 February 2017. In the prior week, mortgage applications had risen 2.3%.

Meanwhile, the Federal Reserve (Fed) Bank of Boston President, Eric Rosengren, stated that the Fed might need to raise interest rates a bit more quickly than the thrice-per-year pace forecast, as the US economy is firming. Separately, the Philadelphia Fed President, Patrick Harker, indicated that three interest rate hikes in 2017 is expected to be the appropriate path for the Fed’s monetary policy, assuming that the US economy stays on track. He further added that US inflation is likely to rise to the central bank’s 2.0% target sometime this year or next.

In the Asian session, at GMT0400, the pair is trading at 1.0611, with the EUR trading 0.18% higher against the USD from yesterday’s close.

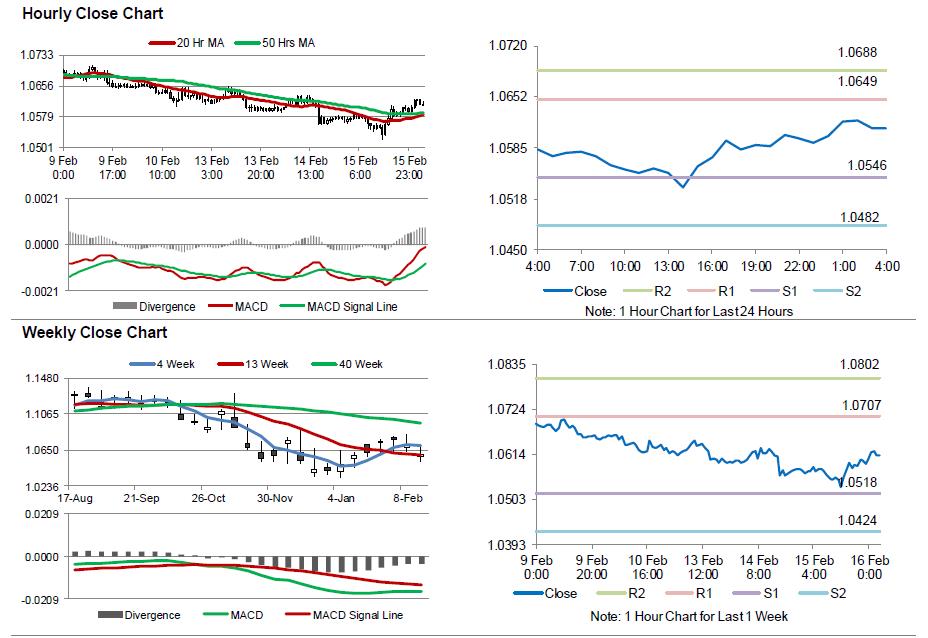

The pair is expected to find support at 1.0546, and a fall through could take it to the next support level of 1.0482. The pair is expected to find its first resistance at 1.0649, and a rise through could take it to the next resistance level of 1.0688.

Trading trend in the Euro today is expected to be determined by the release of European Central Bank’s (ECB) meeting minutes, scheduled later today. Also, the US housing starts and building permits, both for January along with weekly initial jobless claims data, will be eyed by traders.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.