For the 24 hours to 23:00 GMT, the GBP declined 0.1% against the USD and closed at 1.2458, after the latest jobs report indicated that UK’s wage growth surprisingly slowed in the three months to December.

Data showed that Britain’s average earnings including bonus rose less-than-expected by 2.6% in the October-December period, highlighting that wage growth could well remain soft in coming months. Average earnings rose 2.8% in the previous period, while markets were anticipating it to rise 2.8%. However, the nation’s ILO unemployment rate remained unchanged at an eleven-year low level of 4.8% in the three months to December, in line with market expectations.

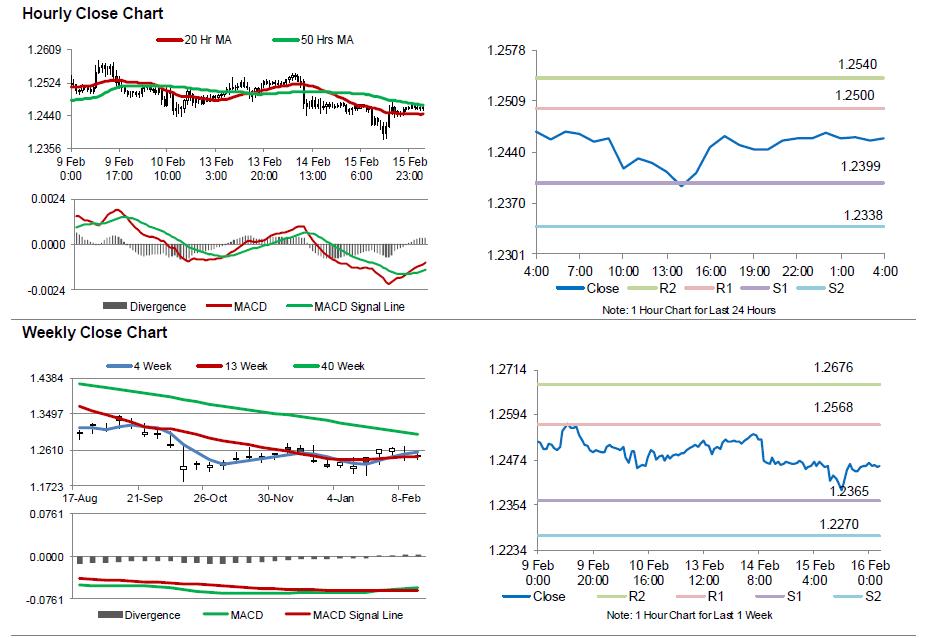

In the Asian session, at GMT0400, the pair is trading at 1.2459, with the GBP trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2399, and a fall through could take it to the next support level of 1.2338. The pair is expected to find its first resistance at 1.2500, and a rise through could take it to the next resistance level of 1.2540.

With no economic releases in UK today, investors will look forward to global events for further direction.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.