For the 24 hours to 23:00 GMT, the EUR rose 0.32% against the USD and closed at 1.1656, after Eurozone manufacturing activity expanded at the fastest pace in more than six years to 58.5 in October, but missed preliminary reading for an advance to a level of 58.6. The manufacturing PMI had registered a level of 58.1 in the previous month.

In Germany, the final manufacturing PMI remained unchanged at a level of 60.6 in October from the prior month. Markets were expecting to ease to a level of 60.5. Additionally, the seasonally adjusted unemployment rate in Germany remained flat at 5.6% in October, meeting expectations.

The US Dollar ended lower against its peers, despite the House of Representatives unveiling a much awaited tax plan and Donald Trump’s nomination of Federal Reserve (Fed) Governor, Jerome Powell, as the next Fed Chairman. In the tax reform bill, Republicans called for slashing the corporate tax rate to 20.0% from 35.0%, cutting tax rates on companies’ profits from overseas operations and on individuals and families.

Macroeconomic releases showed that US initial jobless claims unexpectedly declined to a level of 229.0K in the week ended 28 October 2017, compared to a revised reading of 234.0K in the prior week. Market anticipation was for initial jobless claims to rise to 235.0K. Moreover, the number of planned layoffs by US companies slid 3.0% on an annual basis in October from a drop of 27.0% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1658, with the EUR trading a tad higher from yesterday’s close.

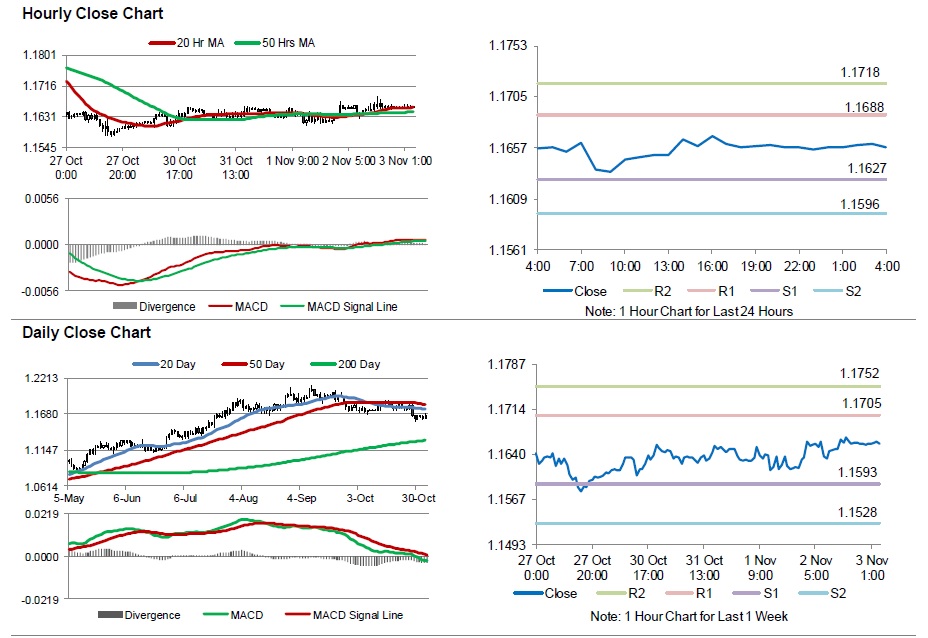

The pair is expected to find support at 1.1627, and a fall through could take it to the next support level of 1.1596. The pair is expected to find its first resistance at 1.1688, and a rise through could take it to the next resistance level of 1.1718.

With no major economic releases in the Eurozone today, investors will keep a tab on US non-farm payrolls report for October, along with unemployment rate and the ISM non-manufacturing PMI, all due later in the day for further direction. Also, US factory orders and durable goods orders, both for September, and the final Markit services PMI data for October, all due today would be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.