For the 24 hours to 23:00 GMT, the GBP declined 1.48% against the USD and closed at 1.3053, following a dovish statement by the Bank of England (BoE).

The BoE’s Monetary Policy Committee (MPC) increased its key interest rate to 0.50% from 0.25% by a majority vote of 7-2, its first hike since July 2007, in an effort to combat rising inflation and bring it back to its 2.0% targeted level. However, the central bank added that future interest rate hikes would be “very gradual” and to a limited extent. BoE Governor, Mark Carney, stated that the Brexit talks would be the most important factor for the next move on interest rates, which could either go up or down.

On the data front, UK’s construction PMI rose to 50.8 in October, more than market expectations of an advance to a level of 48.5. In the previous month, the construction PMI had recorded a level of 48.1.

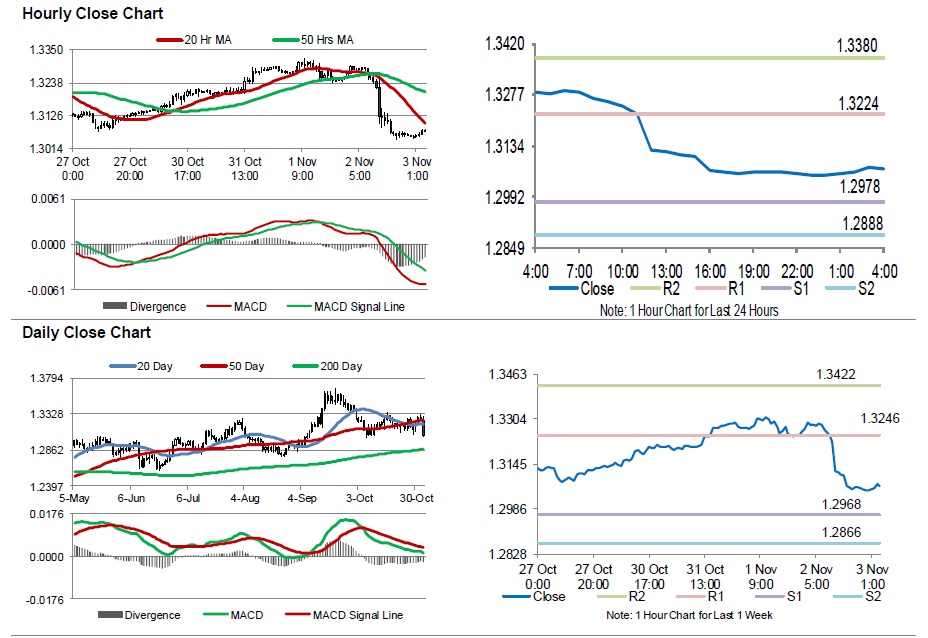

In the Asian session, at GMT0400, the pair is trading at 1.3069, with the GBP trading 0.12% higher from yesterday’s close.

The pair is expected to find support at 1.2978, and a fall through could take it to the next support level of 1.2888. The pair is expected to find its first resistance at 1.3224, and a rise through could take it to the next resistance level of 1.3380.

Moving ahead, UK Markit services PMI data for October, set to release in a few hours, would be closely assessed by market participants.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.