For the 24 hours to 23:00 GMT, the EUR declined 0.71% against the USD and closed at 1.0633.

On the economic front, the Euro-zone’s final consumer price index rose 1.1% on an annual basis in December, in line with preliminary estimates, thus hinting that the threat of deflation in the common currency region has abated. In the prior month, the consumer price index had advanced 0.6%. Additionally, the region’s seasonally adjusted construction output advanced 0.4% on a monthly basis in November and after recording a revised similar rise in the previous month.

Separately, Germany’s final consumer price index rose as initially expected by 1.7% YoY in December, maintaining its highest level since July 2013 and following a gain of 0.8% in the previous month.

The US Dollar gained ground against its key counterparts, after comments from the Federal Reserve (Fed) Chairwoman, Janet Yellen, suggested a faster rate of interest rates hikes in the US this year.

The US Fed Chair, speaking in San Francisco, warned that holding off too long to begin raising interest rates could risk a “nasty surprise” of inflation for the US economy. Further, she pointed strongly to the prospect of further tightening of monetary policy this year by stating that the US economy is near full employment and inflation is moving toward the central bank’s goal.

Separately, the Fed’s Beige Book report revealed that US economy continued to expand at a modest pace across most regions from late November through the end of 2016 and firms expressed optimism about growth in 2017. Further, the report pointed to a jump in manufacturing and tighter labour markets. Also, it noted that most districts indicated modest increase in wages, while prices pressures intensified.

Gains in the greenback were boosted further, after data indicated that the US consumer price index advanced 2.1% on an annual basis in December, meeting market expectations and marking its fastest increase since June 2014, thus backing hopes for an aggressive rate hikes this year. In the prior month, the consumer price index had risen 1.7%. Moreover, the nation’s industrial production grew at its fastest pace in more than two years, after it rebounded 0.8% on a monthly basis in December, surpassing market consensus for an advance of 0.6%. In the prior month, industrial production had fallen by a revised 0.7%. Meanwhile, the nation’s manufacturing production rebounded 0.2% MoM in December, falling short of market expectations for a rise of 0.5% and compared to a fall of 0.1% in the previous month.

Also, the nation’s MBA mortgage applications gained 0.8% in the week ended 13 January 2017, following an increase of 5.8% in the prior week. On the other hand, the nation’s NAHB housing market index unexpectedly fell to a level of 67.0 in January, whereas markets expected the index to remain steady at a revised level of 69.0, recorded in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.0637, with the EUR trading marginally higher against the USD from yesterday’s close.

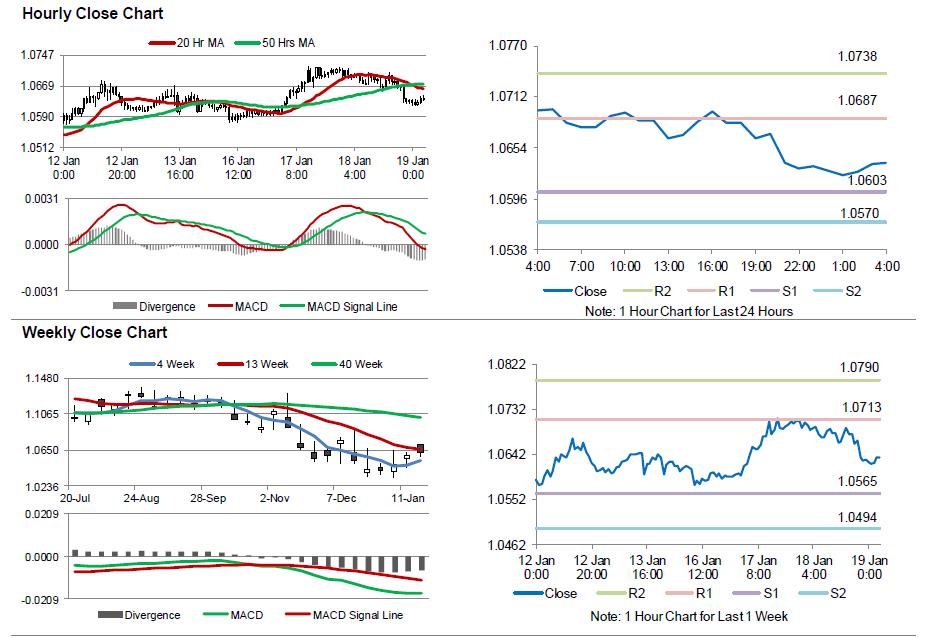

The pair is expected to find support at 1.0603, and a fall through could take it to the next support level of 1.0570. The pair is expected to find its first resistance at 1.0687, and a rise through could take it to the next resistance level of 1.0738.

Ahead in the day, all eyes will be on the European Central Bank’s (ECB) monetary policy meeting. Markets broadly expects the interest rate to be pegged at 0.00%. Moreover, investors will look forward to the US weekly jobless claims coupled with housing starts and building permits, both for December, slated to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.