For the 24 hours to 23:00 GMT, the GBP declined 1.14% against the USD and closed at 1.2262.

Macroeconomic data revealed that UK’s ILO unemployment rate remained unchanged at an eleven-year low level of 4.8% in the September-November 2016 period, meeting market expectations. However, the number of people in employment fell by 9.0K in the same period, declining for the second consecutive month. Meanwhile, investors had envisaged for a decline of 35.0K and after recording a drop of 6.0K in the August-October 2016 period.

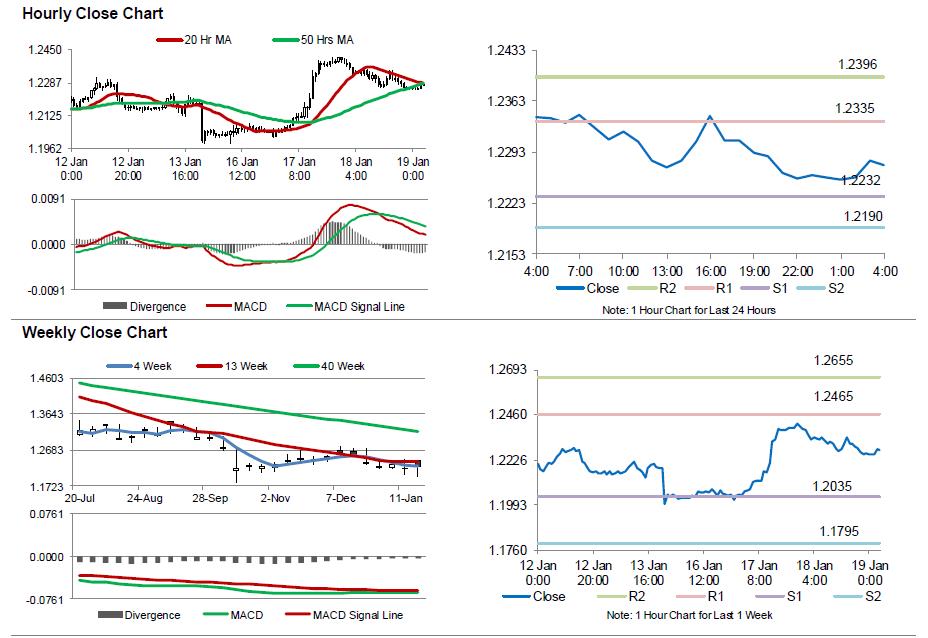

In the Asian session, at GMT0400, the pair is trading at 1.2275, with the GBP trading 0.11% higher against the USD from yesterday’s close.

Overnight data indicated that the nation’s RICS house price balance surprisingly eased to 24.0% in December, defying market expectations for a rise to 30.0% and compared to a revised reading of 29.0% in the prior month.

The pair is expected to find support at 1.2232, and a fall through could take it to the next support level of 1.2190. The pair is expected to find its first resistance at 1.2335, and a rise through could take it to the next resistance level of 1.2396.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.