For the 24 hours to 23:00 GMT, EUR rose marginally against the USD and closed at 1.3657.

Yesterday, the Federal Reserve policymakers unanimously voted to further cut the stimulus measures. The central bank announced another $10 billion reduction in asset purchases to $65 billion at the Ben Bernanke’s last policy meeting. The Federal Reserve, however, reiterated to keep interest rates low until the unemployment rate drops below 6.5%.

On the economic front, that GfK consumer confidence survey index in Germany rose to a level of 8.2 in February, compared to a reading of 7.7 reported in the previous month. Market expected the index to rise to a level of 7.6. The Spanish retail sales dropped 1.0% on a seasonally adjusted annual basis in December, compared to a revised 1.8% increase recorded in November. Separately, business confidence in Italy fell to a reading of 97.7 in January, following a level of 98.2 reported in the preceding month. Markets were expecting the Italian business confidence to increase to 98.7 in January. Additionally, M3 money supply in the Eurozone rose 1.0% (YoY) in December, compared to a 1.5% rise recorded in the previous month. Markets expected M3 money supply to rise 1.7%.

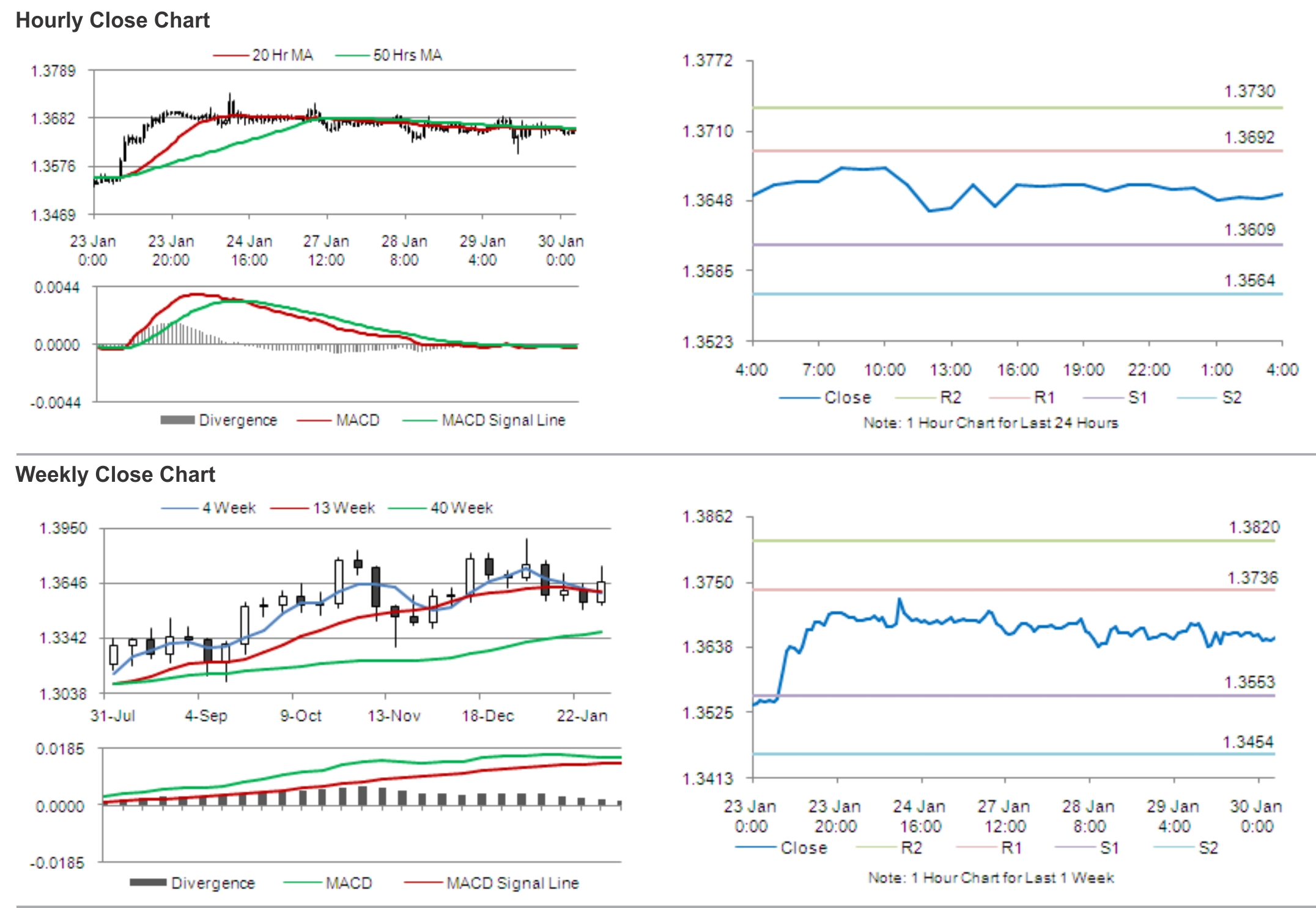

In the Asian session, at GMT0400, the pair is trading at 1.3653, with the EUR trading slightly lower from yesterday’s close.

The pair is expected to find support at 1.3609, and a fall through could take it to the next support level of 1.3564. The pair is expected to find its first resistance at 1.3692, and a rise through could take it to the next resistance level of 1.3730.

Market participants await a series of important economic indicators from the Euro-zone in the rest of the week, especially consumer prices and employment data from Germany and Euro-zone.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.