For the 24 hours to 23:00 GMT, GBP fell 0.06% against the USD and closed at 1.6558, after the Bank of England (BoE) Governor, Mark Carney, reiterated that the UK economic recovery has still a long way to go before considering a hike in interest rates. Additionally, the US Dollar ticked up after the Federal Reserve’s decision to alter its asset purchase program further by $10 billion to $65 billion.

Economic reports released yesterday showed that Nationwide house prices in the UK climbed 8.8% (YoY) in January, compared to a 8.4% rise recorded in the previous month. Markets expected house prices to rise 8.5%. Meanwhile, the seasonally adjusted monthly house price index in the UK increased 0.7% in January, following a 1.4% rise recorded in the previous month.

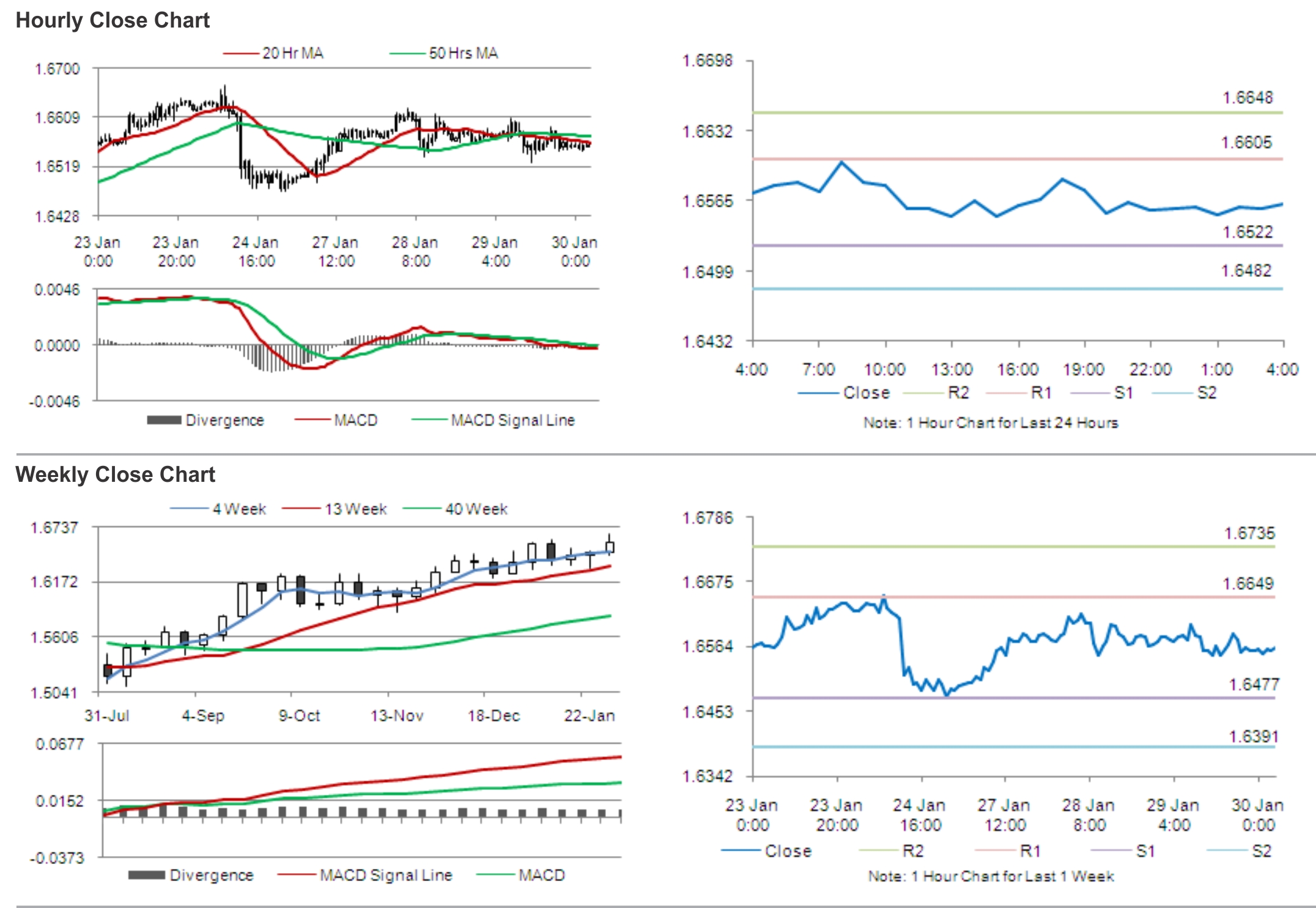

In the Asian session, at GMT0400, the pair is trading at 1.6562, with the GBP trading tad higher from yesterday’s close.

The pair is expected to find support at 1.6522, and a fall through could take it to the next support level of 1.6482. The pair is expected to find its first resistance at 1.6605, and a rise through could take it to the next resistance level of 1.6648.

UK economic data scheduled today includes consumer credit, money supply and mortgage approvals for December.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.