For the 24 hours to 23:00 GMT, the EUR rose 0.42% against the USD and closed at 1.3870. The US Dollar lost ground after data showed that annualised GDP in the US rose 0.1% in the first quarter, the slowest pace of quarterly rise since the end of 2012. However, losses in the greenback were kept in check after the ADP reported that the US private sector added more-than-expected 220,000 jobs in April and after the Fed expressed optimism on the recovery of the US economy and trimmed the size of its monthly QE package by yet another $10 billion.

In other US economic news, US personal consumption rose 3.0% (QoQ) in the first quarter, slightly down from a growth of 3.3% in the fourth quarter of 2013 while the Chicago purchasing managers’ index rose to a five-month high reading of 63.0 in April, far above analysts’ expectations for a rise to 56.7.

In the Euro-zone, Italy’s Finance Minister, Pier Carlo Padoan stated that although he did not see any reasons for a strong depreciation in the Euro, a softer Euro was always welcome, which according to him, “would help the economy” by taking-off “some of the pressure towards deflation in Europe.” Separately, an ECB policymaker, Christian Noyer, highlighted his desire for the central bank to take one or two further measures, including injecting more liquidity to strengthen the Euro-zone economy.

On the economic front, Euro-zone’s annual consumer inflation rate accelerated slightly to 0.7% in April, failing to meet economists’ expectations for a rise to 0.8% from previous month’s level of 0.5%. Meanwhile, the number of unemployed people in Germany declined more-than-expected by 25,000 to 2.872 million last month while the seasonally adjusted unemployment rate remained unchanged at 6.7% in April, the lowest level in two decades. However, retail sales in Germany unexpectedly declined 1.9% (YoY) in March, for the first time since December 2013.

In the Asian session, at GMT0300, the pair is trading at 1.3871, with the EUR trading marginally higher from yesterday’s close.

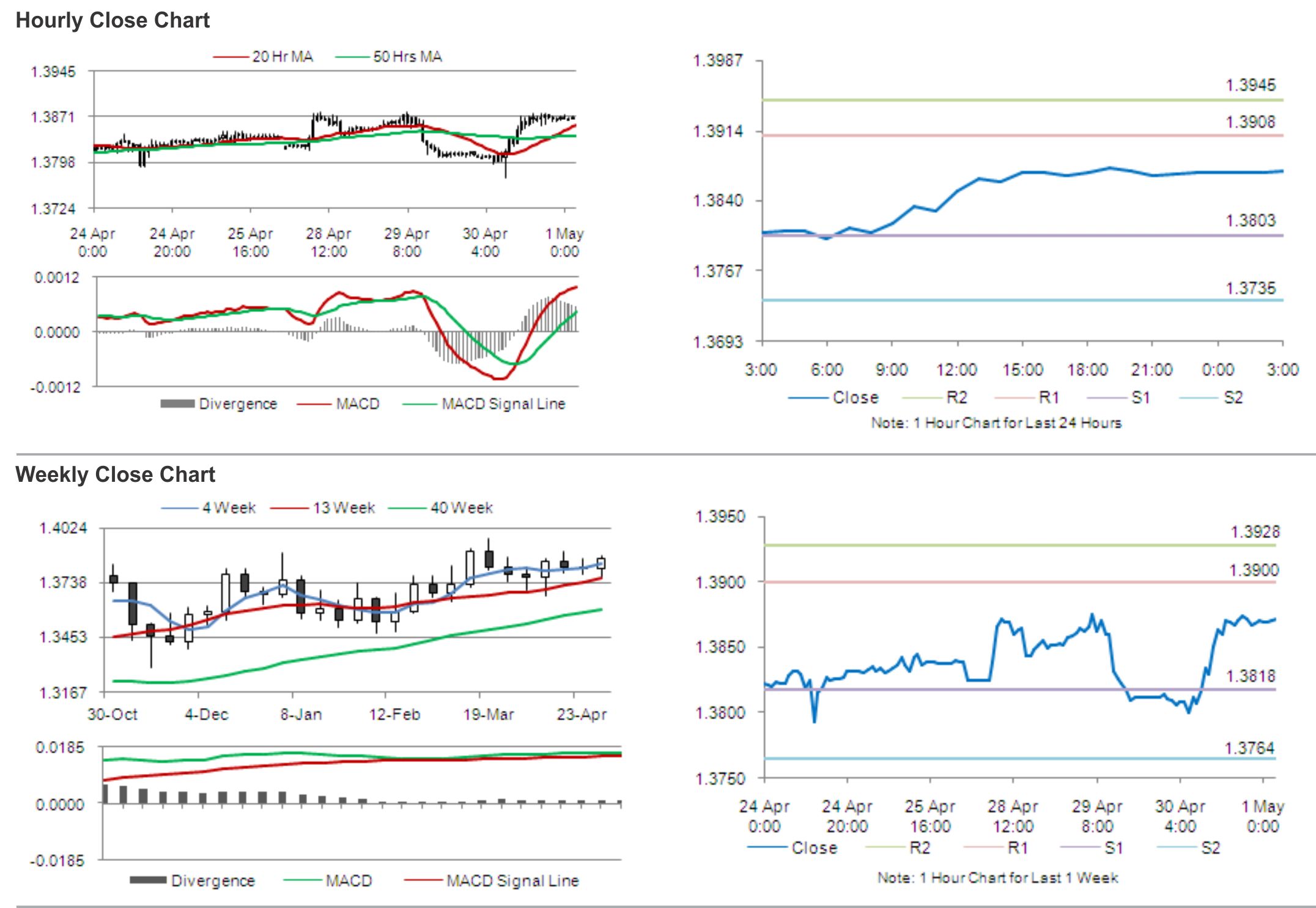

The pair is expected to find support at 1.3803, and a fall through could take it to the next support level of 1.3735. The pair is expected to find its first resistance at 1.3908, and a rise through could take it to the next resistance level of 1.3945.

With no major economic releases in the Euro-zone due to a Labour Day public holiday in most of its member nations, traders would eye global economic news, along with the US ISM manufacturing data, for further cues in the currency pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.