For the 24 hours to 23:00 GMT, the GBP rose 0.30% against the USD and closed at 1.6876 as the latter declined following the release of a soft US GDP data for the first-quarter.

In the UK, BoE’s Andrew Haldane, in a testimony to lawmakers, opined that interest rates in the nation were widely expected to rise only gradually and not immediately adding that it constituted the most central element in the central bank’s forward guidance. Furthermore, he highlighted his agreement to the MPC’s view on economy’s slackness by stating that central bank’s expectations for slackness between 1% to 1.5% range seems a reasonable estimate.

Meanwhile, another BoE policymaker, Spencer Dale stated that UK housing market was not showing signs of a price bubble at the moment but at the very same time he cautioned that policymakers “should be nervous” about the pace of the recovery.

In the Asian session, at GMT0300, the pair is trading at 1.6880, with the GBP trading marginally higher from yesterday’s close.

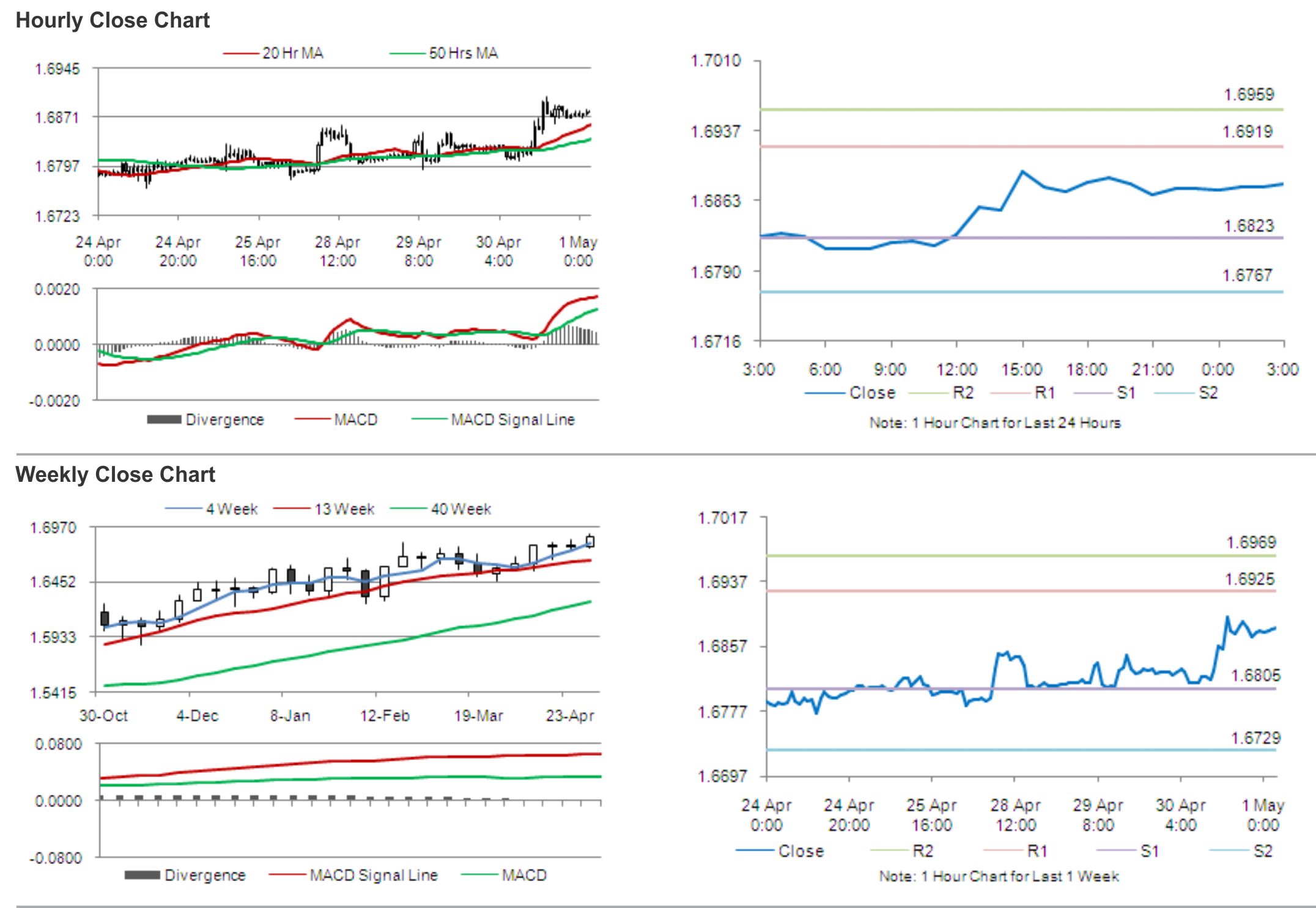

The pair is expected to find support at 1.6823, and a fall through could take it to the next support level of 1.6767. The pair is expected to find its first resistance at 1.6919, and a rise through could take it to the next resistance level of 1.6959.

Market participants keenly await UK’s Markit manufacturing PMI, consumer credit and mortgage approvals data, slated for release later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.