For the 24 hours to 23:00 GMT, the EUR declined 0.89% against the USD and closed at 1.1824, following downbeat GDP figures across the Euro-zone.

Data indicated that the Euro-zone’s seasonally adjusted flash gross domestic product (GDP) rose 0.4% on a quarterly basis in the first three months of 2018, in line with market expectations.

In other economic news, the region’s ZEW economic sentiment index advanced to a level of 2.4 in May, compared to a level of 1.9 in the previous month. Further, the region’s seasonally adjusted industrial production gained 0.5% on a monthly basis in March, undershooting market expectations for a rise of 0.7%. Industrial production had registered a revised drop of 0.9% in the previous month.

Separately, Germany’s seasonally adjusted flash GDP advanced 0.3% QoQ in 1Q 2018, falling short of market consensus for a rise of 0.4%. In the previous quarter, the nation had registered an expansion of 0.6%. Meanwhile, the nation’s ZEW economic sentiment index remained unchanged at a level of -8.2 in May, in line with market expectations.

The US Dollar advanced against a basket of major currencies, following a pair of upbeat economic releases in the US.

Data indicated that advance retail sales in the US climbed 0.3% on a monthly basis in April, meeting market expectations and compared to a revised gain of 0.8% in the prior month. Also, the nation’s NAHB housing market index climbed more-than-anticipated to a level of 70.0 in May, compared to a revised reading of 68.0 in the prior month, while markets were expecting the index to advance to a level of 69.0.

Another set of data showed that business inventories in the US remained flat on a monthly basis in March, defying market consensus for a rise of 0.1%. Business inventories had posted an advance of 0.6% in the previous month. Additionally, the nation’s New York Empire State manufacturing index unexpectedly increased to a level of 20.1 in May, compared to a level of 15.8 in the previous month and confounding market consensus for it to ease to a level of 15.0.

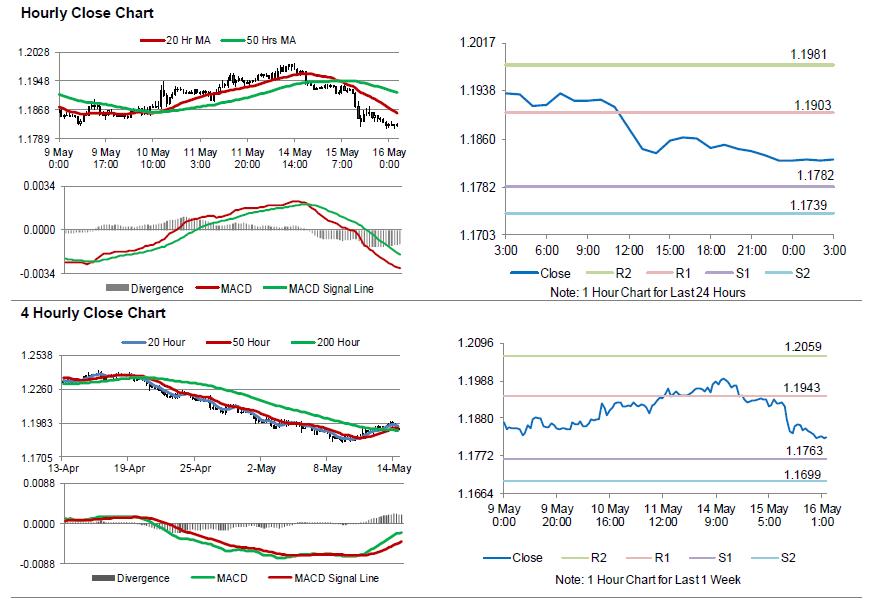

In the Asian session, at GMT0300, the pair is trading at 1.1826, with the EUR trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1782, and a fall through could take it to the next support level of 1.1739. The pair is expected to find its first resistance at 1.1903, and a rise through could take it to the next resistance level of 1.1981.

Moving ahead, investors would focus a speech by the ECB President, Mario Draghi, due later in the day. Also, the release of final inflation figures for April across the Euro-zone, scheduled to release in a few hours, will be eyed by traders. Moreover, the US housing starts and building permits as well as industrial and manufacturing production, all for April, slated to release later in the day, will garner significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.