For the 24 hours to 23:00 GMT, the GBP declined 0.44% against the USD and closed at 1.3501, after fresh figures pointed to a slowdown in UK’s wage growth.

On the macro front, Britain’s ILO unemployment rate remained steady at 4.2% in the January-March 2018 period, at par with market expectations. However, the nation’s average earnings including bonus grew less-than-expected by 2.6% in the three months to March, meeting market expectations. Average earnings including bonus had risen 2.8% in the December-February 2018 period.

In the Asian session, at GMT0300, the pair is trading at 1.3498, with the GBP trading marginally lower against the USD from yesterday’s close.

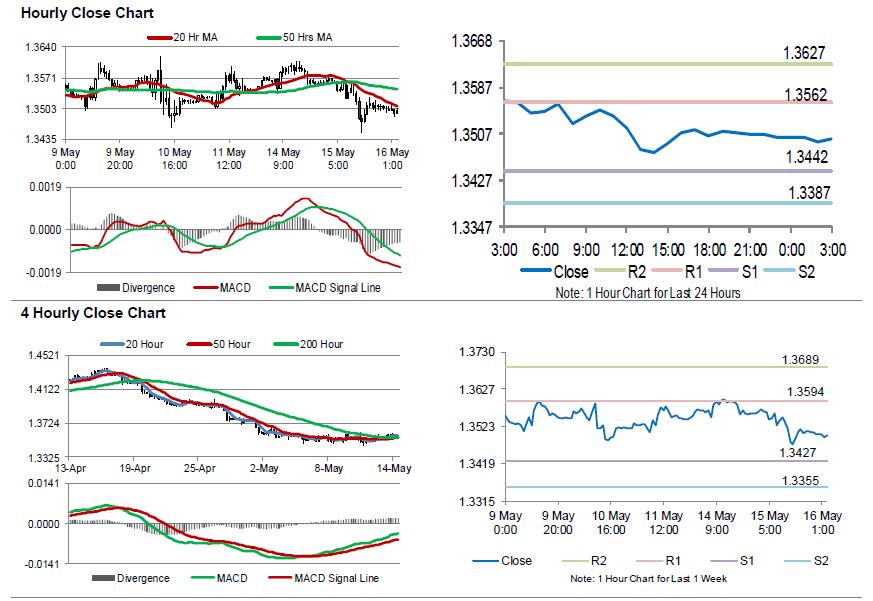

The pair is expected to find support at 1.3442, and a fall through could take it to the next support level of 1.3387. The pair is expected to find its first resistance at 1.3562, and a rise through could take it to the next resistance level of 1.3627.

With no key macroeconomic releases in the UK today, investor sentiment would be determined by global macroeconomic factors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.