For the 24 hours to 23:00 GMT, the EUR declined 0.48% against the USD and closed at 1.0409.

On the economic front, Germany’s flash consumer price index (CPI) jumped more-than-expected by 1.7% on an annual basis in December, notching its highest level since July 2013, thus suggesting that aggressive measures taken by the European Central Bank (ECB) to boost inflation are working. In the previous month, the CPI had registered a rise of 0.8%, while markets expected for an advance of 1.4%. Moreover, the nation’s seasonally adjusted unemployment rate remained unchanged at a level of 6.0% in December, in line with market expectations.

The US Dollar gained ground against its key counterparts, after robust economic data in the US reinforced optimism over the health of the economy.

Data indicated that the US ISM manufacturing activity index advanced more-than-anticipated to a level of 54.7 in December, expanding at its fastest pace in two years, highlighting that factories ended the year on a strong footing. Markets expected the index to advance to a level of 53.8, following a level of 53.2 in the previous month. Additionally, the nation’s construction spending surged to a more than ten-year high level, after it unexpectedly climbed 0.9% on a monthly basis in November, confounding market expectations for an advance of 0.5% and after recording a revised gain of 0.6% in the prior month. Further, the nation’s final Markit manufacturing PMI surprisingly inched higher to a level of 54.3 in December, defying market expectations for the index to remain steady at 54.2, recorded in the preliminary print. In the previous month, the index had registered a level of 54.1.

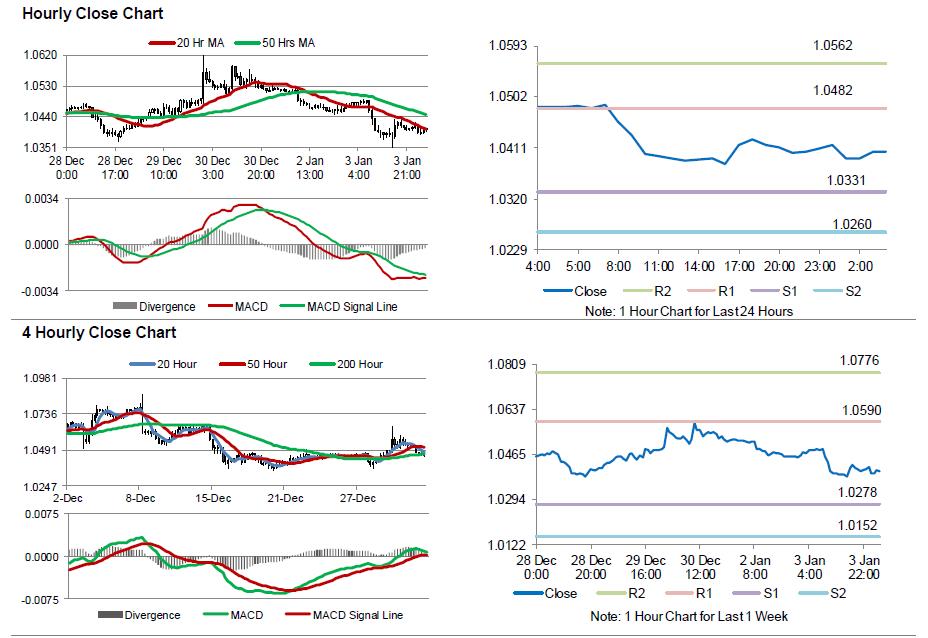

In the Asian session, at GMT0400, the pair is trading at 1.0403, with the EUR trading 0.06% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0331, and a fall through could take it to the next support level of 1.0260. The pair is expected to find its first resistance at 1.0482, and a rise through could take it to the next resistance level of 1.0562.

Moving ahead, investors will focus on the final Markit services PMI for December across the Euro-zone along with the region’s flash consumer price index for December, all scheduled to release in a few hours. Moreover, in the US, the FOMC minutes, ADP employment change for December and weekly mortgage applications data, slated to release later in the day, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.