For the 24 hours to 23:00 GMT, the GBP declined 0.31% against the USD and closed at 1.2237.

In economic news, data showed that UK’s Markit manufacturing PMI unexpectedly rose to a level of 56.1 in December, hitting its highest level in thirty-months, thus offering further signs of strength in the nation’s economy. Markets had envisaged the index to ease to a level of 53.3, following a revised level of 53.6 in the previous month.

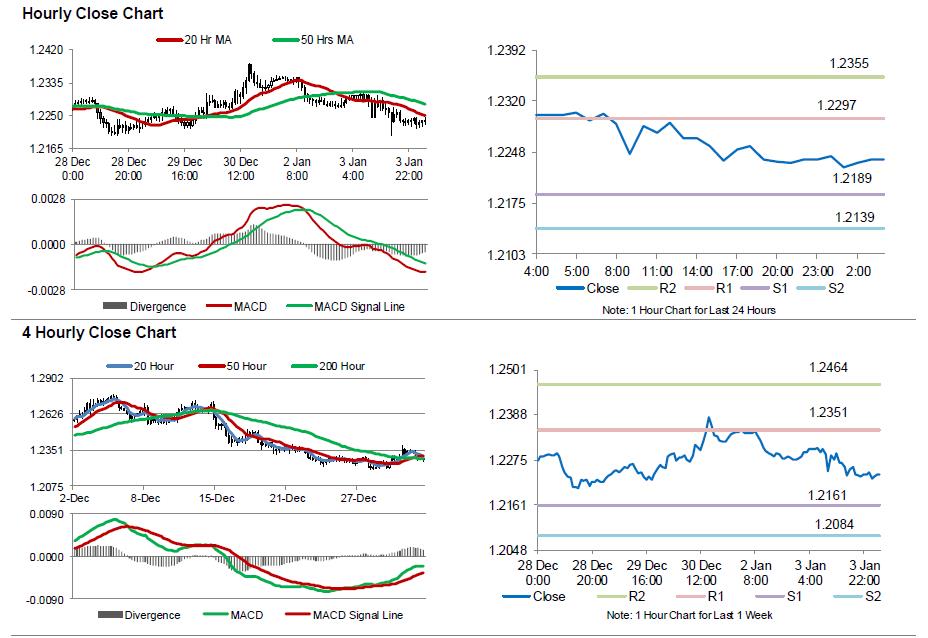

In the Asian session, at GMT0400, the pair is trading at 1.2238, with the GBP trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2189, and a fall through could take it to the next support level of 1.2139. The pair is expected to find its first resistance at 1.2297, and a rise through could take it to the next resistance level of 1.2355.

Ahead in the day, traders will closely monitor UK’s Markit construction PMI for December, accompanied with consumer credit and mortgage approvals, both for November.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.