For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.0908.

In economic news, data indicated that Germany’s GfK consumer confidence index unexpectedly eased to a level of 9.7 in November, hitting its lowest level since April 2016, hurt by concerns that weakness in global economy may drag on the nation’s economic growth. Meanwhile, markets expected the index to remain steady at 10.0, recorded in the previous month. On the contrary, the nation’s import price index surprisingly climbed by 0.1% MoM in September, compared to market expectations for a flat reading and following a drop of 0.2% in the previous month.

In the US, data showed that advance goods trade deficit unexpectedly narrowed to a level of $56.1 billion in September, from a deficit of $59.2 billion in the preceding month and compared to investor consensus for it to rise to a level of $60.5 billion. Additionally, the nation’s new home sales surprisingly advanced by 3.1% on a monthly basis to a level of 593.0K in September, suggesting continued modest momentum in the nation’s housing sector. Markets expected for a rise to a level of 600.0K, following a revised reading of 575.0K in the previous month. Moreover, the nation’s flash Markit services PMI unexpectedly climbed to an eleven-month high level of 54.8 in October, surpassing market expectations for it to remain steady at 52.3, recorded in the previous month. On the other hand, the nation’s MBA mortgage applications dropped by 4.1% in the week ended 21 October 2016, after recording a rise of 0.6% in the prior week.

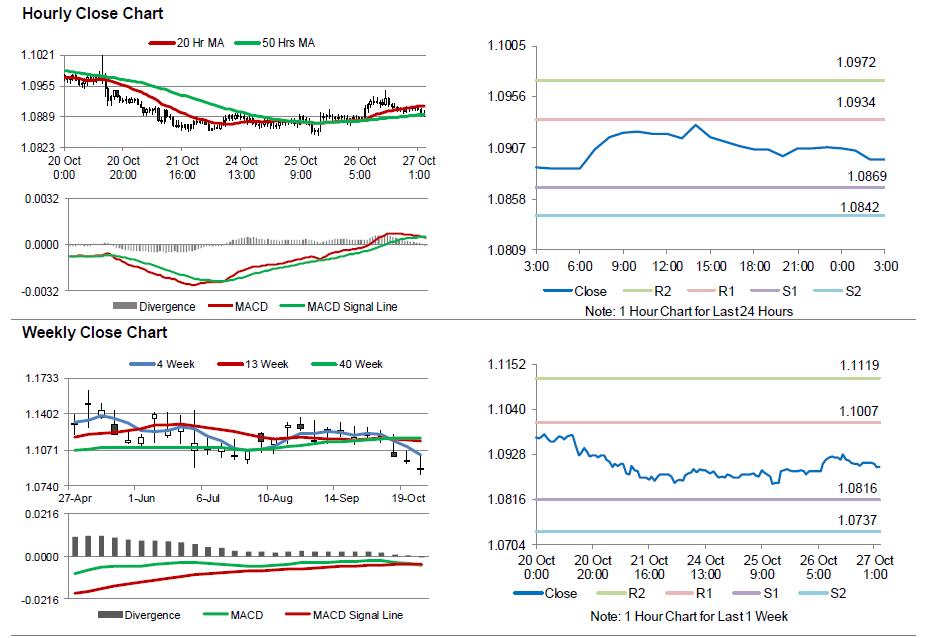

In the Asian session, at GMT0300, the pair is trading at 1.0896, with the EUR trading 0.11% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0869, and a fall through could take it to the next support level of 1.0842. The pair is expected to find its first resistance at 1.0934, and a rise through could take it to the next resistance level of 1.0972.

Amid no major economic releases in the Euro-zone today, investors would look forward to the US durable goods orders and pending home sales, both for September along with initial jobless claims data, all slated to release later in the day.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.