For the 24 hours to 23:00 GMT, the GBP rose 0.45% against the USD and closed at 1.2235, after UK’s BBA mortgage approvals rose more-than-anticipated to a level of 38.3K in September, notching its highest level in three-months, against market expectations of a rise to a level of 37.3K and following a revised reading of 37.2K in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.2212, with the GBP trading 0.19% lower against the USD from yesterday’s close.

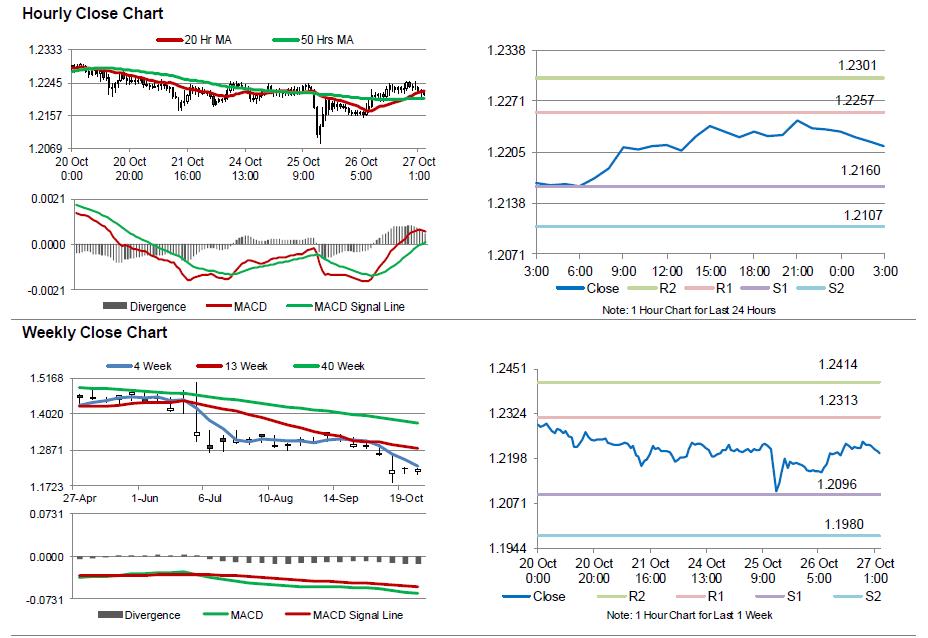

The pair is expected to find support at 1.2160, and a fall through could take it to the next support level of 1.2107. The pair is expected to find its first resistance at 1.2257, and a rise through could take it to the next resistance level of 1.2301.

Moving ahead, UK’s flash GDP data for 3Q, scheduled to release in a few hours accompanied with GfK consumer confidence index for October, due to release later today, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.