For the 24 hours to 23:00 GMT, the EUR declined 0.2% against the USD and closed at 1.1213, after Germany’s final consumer price index remained flat on a monthly basis in August, in line with market expectations and confirming the preliminary print. Additionally, the nation’s ZEW economic sentiment index surprisingly remained unchanged at a level of 0.5 in September, suggesting that investors remain vigilant about the growth outlook for Euro-zone’s biggest economy. Meanwhile, markets expected the index to rise to a level of 2.5. Further, the current situation index fell more-than-expected to a level of 55.1 in September, following a level of 57.6 in the preceding month and compared to market expectations for a drop to a level of 56.0. Separately, the Euro-zone’s economic sentiment index rose to a level of 5.4 in September, after recording a level of 4.6 in the previous month.

In the US, the NFIB small business optimism index unexpectedly dropped to a level of 94.4 in August, defying market expectations for an advance to a level of 94.8 and following a reading of 94.6 in the previous month.

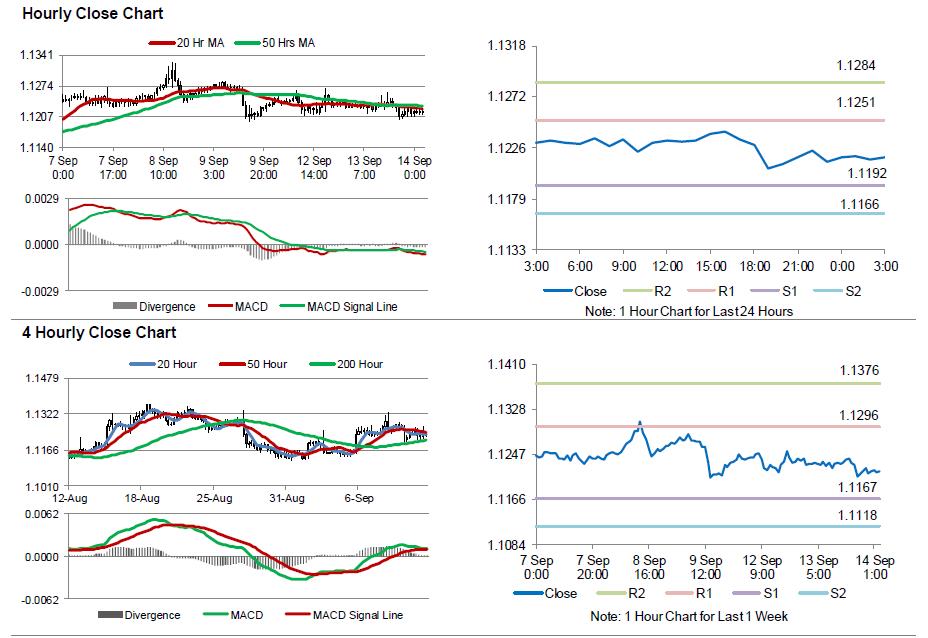

In the Asian session, at GMT0300, the pair is trading at 1.1217, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1192, and a fall through could take it to the next support level of 1.1166. The pair is expected to find its first resistance at 1.1251, and a rise through could take it to the next resistance level of 1.1284.

Going ahead, investors would look forward to Euro-zone’s industrial production data for July, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.