For the 24 hours to 23:00 GMT, the GBP declined 1.05% against the USD and closed at 1.3192, after UK’s consumer price index (CPI) advanced less-than-anticipated by 0.3% on a monthly basis in August, thus keeping the door open for an interest rate cut by the Bank of England. The CPI had recorded a fall of 0.1% in the prior month. Meanwhile, on an annual basis, the CPI held steady at 0.6% in August, undershooting market expectations for an advance of 0.7%.

In the Asian session, at GMT0300, the pair is trading at 1.3189, with the GBP trading marginally lower against the USD from yesterday’s close.

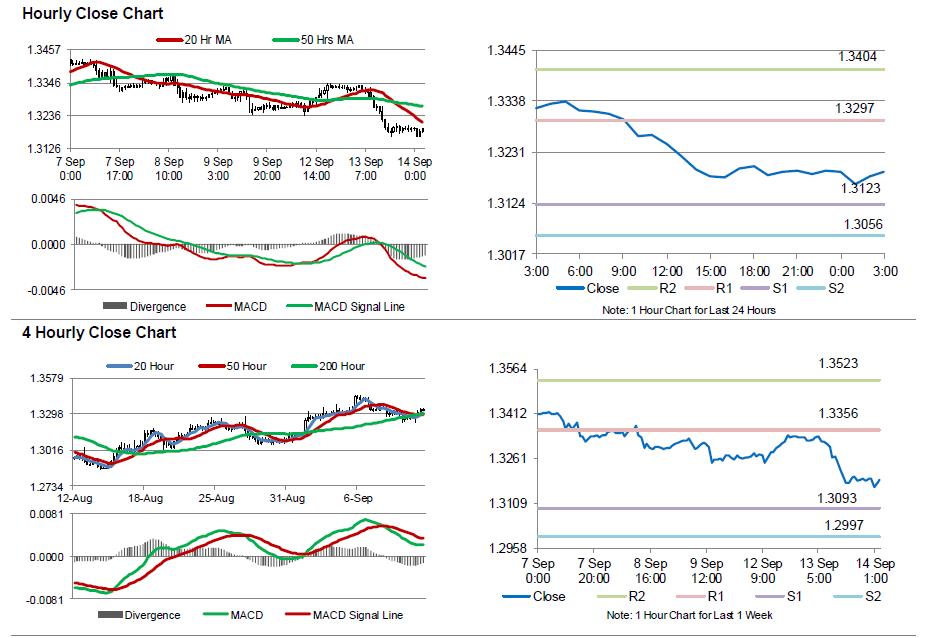

The pair is expected to find support at 1.3123, and a fall through could take it to the next support level of 1.3056. The pair is expected to find its first resistance at 1.3297, and a rise through could take it to the next resistance level of 1.3404.

Moving ahead, investors would closely monitor Britain’s ILO unemployment rate data for July, scheduled to be released in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.