For the 24 hours to 23:00 GMT, the EUR rose slightly against the USD and closed at 1.1221, after Germany’s preliminary consumer price index unexpectedly advanced by 0.1% on a monthly basis in September, indicating that the European Central Bank’s ultra-loose monetary policy is working. Meanwhile, markets expected the index to record a flat reading. Moreover, the nation’s seasonally adjusted unemployment rate remained steady at a record low level of 6.1% in September, meeting market expectations. On the contrary, the number of people unemployed in the nation unexpectedly climbed to a level of 1.0K in September, advancing for the first time in 12-months, compared to a revised fall of 6.0K in the prior month.

Separately, the Euro-zone’s final consumer confidence index rose to a level of -8.2 in September, in line with market expectations and confirming the preliminary print.

On the economic front, the second estimate of annualised GDP indicated that economic growth in the US was revised upwards to 1.4% on a quarterly basis in the second quarter, compared to an expansion of 1.1% in the preliminary figure and beating market expectations for an advance of 1.3%. Also, the nation’s advance goods trade deficit unexpectedly narrowed to a level of $58.4 billion in August, from a deficit of $58.8 billion in the preceding month and compared to investor consensus for it to rise to a level of $62.3 billion. Meanwhile, the nation’s initial jobless claims rose to a level of 254.0K in the week ended 24 September 2016, falling short of market expectations for a rise to a level of 260.0K and compared to a revised level of 251.0K in the prior week. On the other hand, the nation’s pending home sales surprisingly eased by 2.4% MoM in August, hitting its lowest level since January 2016, compared to a revised advance of 1.2% in the prior month while markets anticipated pending home sales to record a flat reading.

In the Asian session, at GMT0300, the pair is trading at 1.1215, with the EUR trading a tad lower against the USD from yesterday’s close.

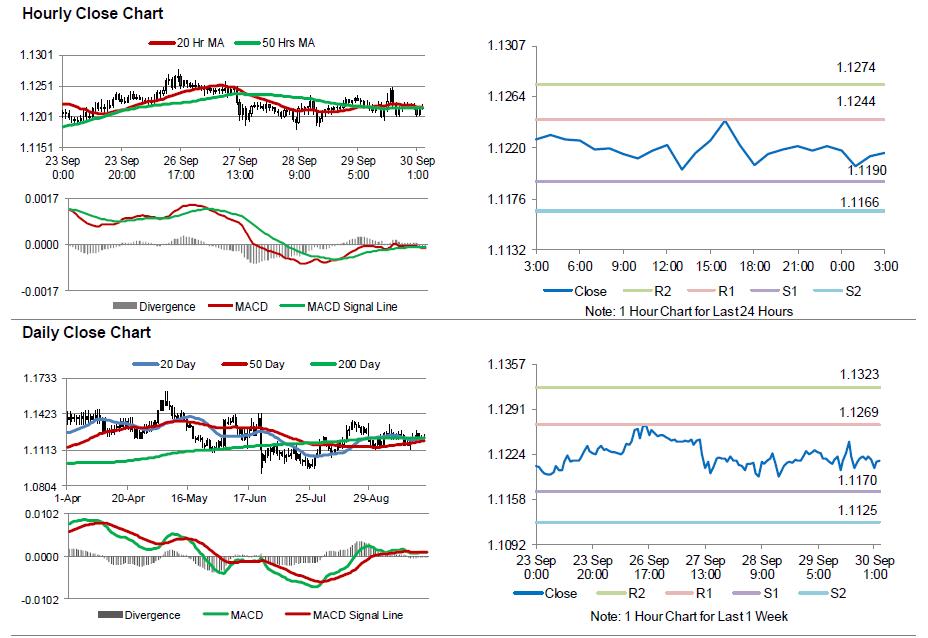

The pair is expected to find support at 1.1190, and a fall through could take it to the next support level of 1.1166. The pair is expected to find its first resistance at 1.1244, and a rise through could take it to the next resistance level of 1.1274.

Moving ahead, market participants would keep a close eye on the Euro-zone’s unemployment rate for August and consumer price index for September, slated to release in a few hours. Moreover, in the US, the final Reuters/Michigan consumer confidence index for September as well as personal income and personal spending for August, slated to release later today, would attract market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.