For the 24 hours to 23:00 GMT, the GBP declined 0.38% against the USD and closed at 1.2968, after the number of mortgage approvals for house purchases in the UK eased to a level of 60.1K in August, dropping to the lowest level since November 2014. Markets expected mortgage approvals to fall to a level of 60.2K, following a level of 60.9K in the prior month. On the other hand, the nation’s net consumer credit advanced to a level of £1.6 billion in August, surpassing market expectations for it to climb to a level of £1.4 billion and compared to an advance of £1.2 billion in the previous month.

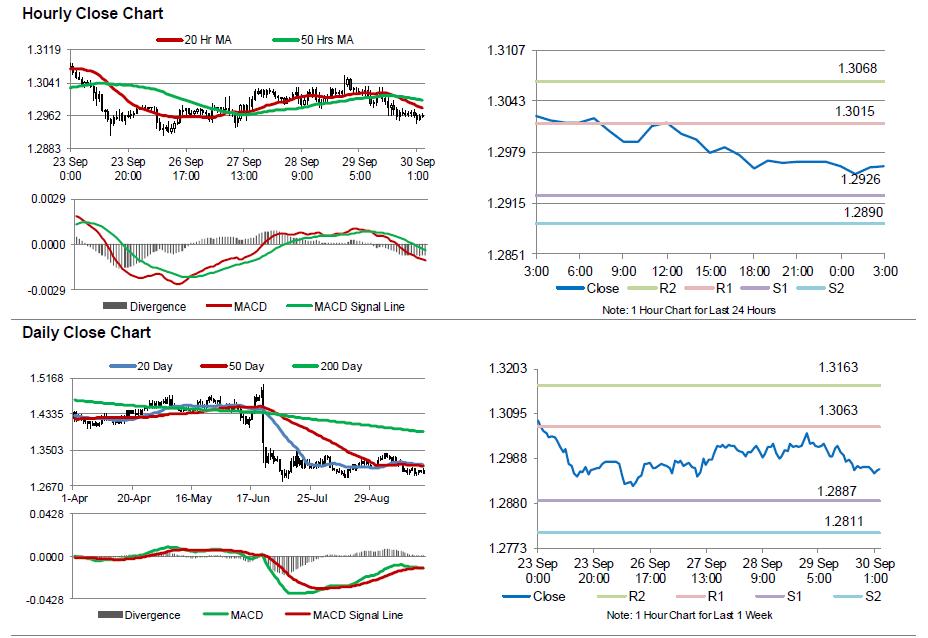

In the Asian session, at GMT0300, the pair is trading at 1.2962, with the GBP trading slightly lower against the USD from yesterday’s close.

Overnight data indicated that, the nation’s GfK consumer confidence index improved more-than-expected to a level of -1.0 in September, but remained in negative territory for a seventh consecutive month. In the previous month, the index had recorded a level of -7.0, compared to market expectations of an advance to a level of -5.0. Further, the nation’s Lloyds business barometer advanced to a level of 24.0 in September, after recording a reading of 16.0 in the prior month.

The pair is expected to find support at 1.2926, and a fall through could take it to the next support level of 1.289. The pair is expected to find its first resistance at 1.3015, and a rise through could take it to the next resistance level of 1.3068.

Moving ahead, investors would closely monitor UK’s final GDP data for the second quarter, slated to release in a few hours, to gauge the strength in the nation’s economy.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.